At Mission Driven Finance, we want impact investing to pick up so much steam that it becomes the default mode of making investments. One of our goals is to make it easier for folks to invest in their community and the issues they care about, from all sorts of types of accounts.

If someone asks, “Can I participate from my ___ [fill-in-the-blank] account?” we want the answer to be an emphatic yes.

To that end, we’re proud to add Realize Impact to our growing community of impact partners. Realize Impact is a 501(c)(3) public charity whose mission is to support donors in turning any grant into an impact investment. Sounds cool, right?

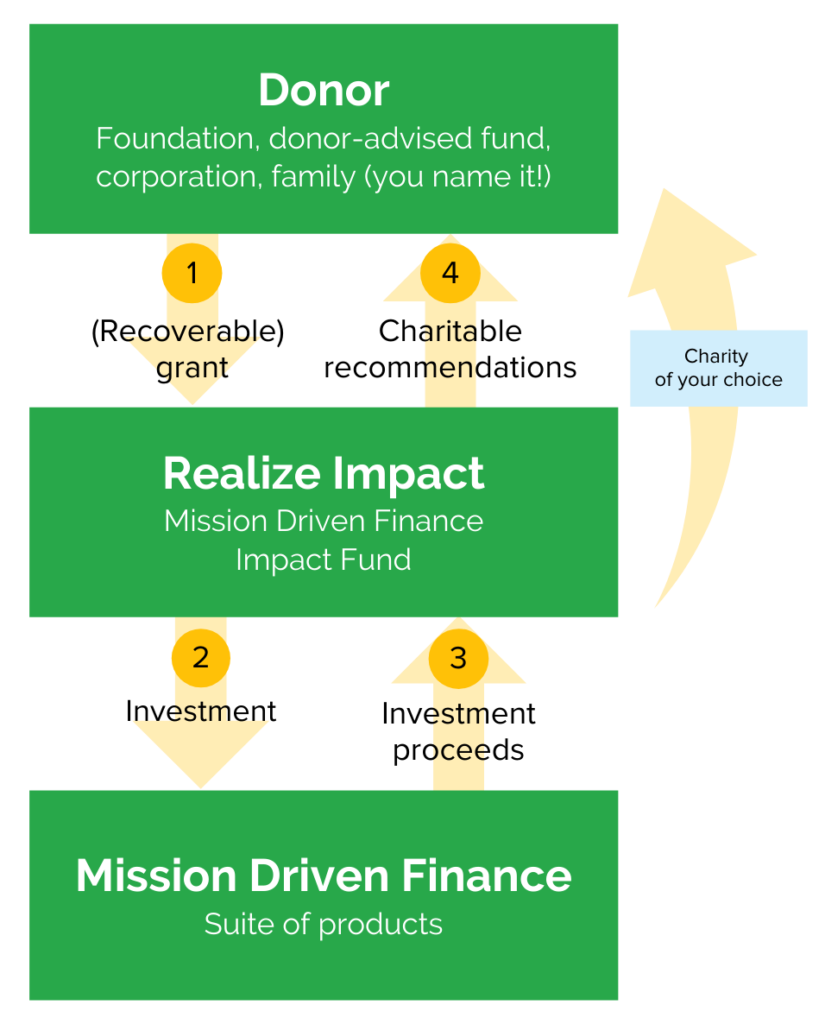

Our partnership with Realize Impact allows Mission Driven Finance to expand our commitment to make impact investing easy and accessible. We look forward to working alongside donors, private foundations, and donor advised funds of any origin and size to unlock grant capital as a tool for impact investing. Here’s how it works:

- Make a grant from your donor-advised fund (DAF) or private foundation, or a tax-deductible donation from your personal account to Realize Impact and recommend an impact investment in one of Mission Driven Finance’s impact strategies.

- Realize Impact operates a philanthropic investment fund that takes money donated from DAFs, foundations, and elsewhere and invests it in existing Mission Driven Finance funds.

- Huzzah! A donation is now at work in the world as an impact investment! While Realize Impact is the investor of record, we keep you up to date along the way on all the impact you’re creating through your charitable participation.

- At the end of the investment term, 99 percent of the investment returns may be granted back to the donor’s DAF, foundation, or another 501(c)(3) of choice—or reinvested for impact.

2020 bonus tax incentives

On top of all this awesomeness, 2020 philanthropic investment grants to Realize Impact are eligible for temporary additional tax benefits.

In a nutshell, the federal government built temporary tax incentives into the CARES Act to urge Americans to make charitable contributions in 2020 and support our neighbors. For those who are in a position to give, there’s no time like the present.

In this historical moment, legacy will undoubtedly be defined by whether or not those positioned to contribute are indeed taking their wealth and responsibility seriously. The options are endless on the spectrum from donating to investing, so that we can collectively come out of the pandemic stronger.

— Morgan Simon, Candide Group

Under the CARES Act, there are added tax benefits for making a charitable gift in 2020.

- For non-itemizers: You can deduct up to $300 of charitable gifts without itemizing.

- For itemizers: You can deduct up to 100 percent of charitable gifts from your adjusted gross income. See further reading resources below for details.

While gifts into donor-advised funds and private foundations are not eligible for the increased 2020 tax benefits, contributions to public charities do qualify. Realize Impact, as a public charity, can accept charitable contributions, eligible for expanded CARES Act tax deductions.

For further reading

- The San Diego Foundation’s 4 Ways to Maximize CARES Act Charitable Giving Deductions in 2020 is a straightforward summary for individuals

- What the CARES Act Means for Charitable Giving [Fidelity Charitable]

- Balancing accessible & technical, this summary from The New York Times is a good one: This Year Only, Tax-Deductible Donations Aren’t Just for Itemizers

- Morgan Simon of Candide Group did a great writeup earlier in the year

Mission Driven Finance is not qualified to give tax advice. This article does not constitute investment, tax, or legal advice. We encourage you to speak with your tax professional about your situation.