As you may have heard, Black business owners were disproportionately hurt by the pandemic. Everyone has a role to play to ensure small businesses thrive. When Black businesses thrive, our overall economy thrives.

According to the report, “If the number of Black businesses matched the population size and the employees per firm matched non-Black businesses, it would create more than 19 million jobs.”

“By ending racism and racist systems and practices, we will grow the economy overall,” says Mission Driven Finance Co-founder and Chief Community Officer Lauren Grattan.

For too long, conventional financial institutions focused mainly on credit and collateral, leaving out the majority of Black Americans who have systematically been denied access to land, wealth, and opportunities for over 400 years.

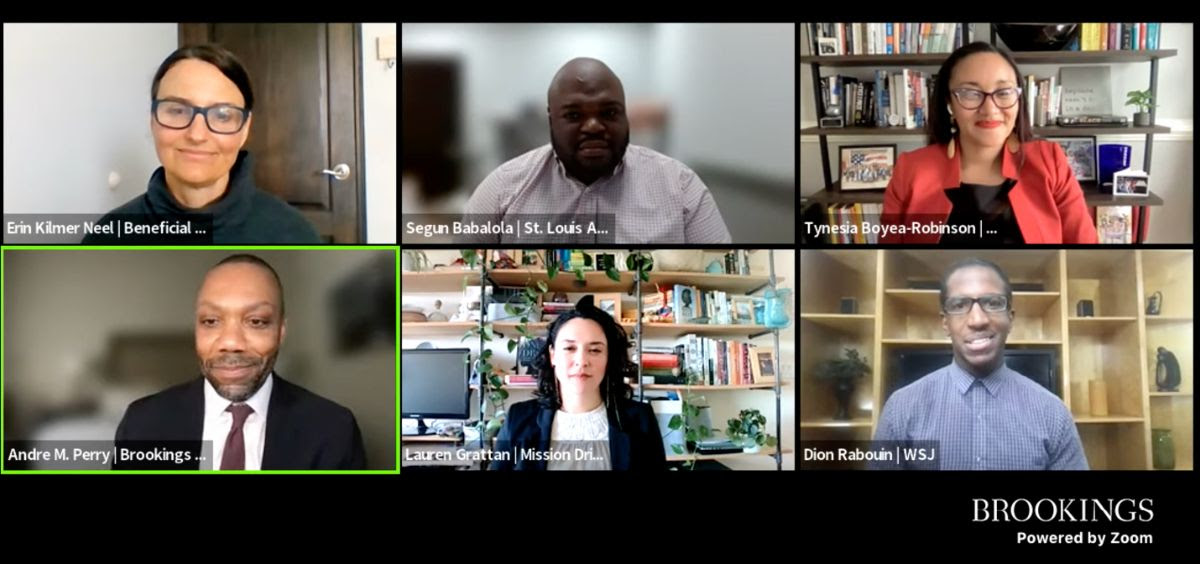

Lauren recently participated in a panel hosted by the Brookings Institution, State of Black Businesses: Resilience in the face of a pandemic, along with:

- Segun Babalola of the City of Dellwood, MO

- Tynesia Boyea-Robinson of CapEQ

- Erin Kilmer Neel of Beneficial State Foundation

- Andre M. Perry of The Brookings Institution (host)

- Dion Rabouin of The Wall Street Journal (moderator)

Brookings Institution Senior Fellow, Andre Perry, shared his findings from a Brookings report, “Black-owned businesses in U.S. cities: The challenges, solutions, and opportunities for prosperity.”

Some key findings found in the report:

- Black business owners were disproportionately hurt by the pandemic.

- Systemic design failures in the Paycheck Protection Program, Economic Injury Disaster Loan program, Restaurant Revitalization Fund, and Shuttered Venue Operators Grant meant Black businesses were less likely to receive aid and received smaller amounts of aid than comparable white businesses.

- The pandemic led to a surge in new Black businesses, driven largely by the impact of individual stimulus checks.

Panelists discussed the current environment for Black-owned businesses, their organizations’ roles in supporting Black-owned businesses, and how to reimagine systems in order to create opportunities for capital and community connections.

“How Black people get access to the real dollars is for the way dollars land to be less biased,” Tynesia Boyea-Robinson President and CEO at CapEQ says in response to an audience question posed by panel moderator Dion Rabouinn, Reporter at Wall Street Journal: “How do Black business organizations gain access to real capital?”

With the new ways to invest and finance lenders, organizations like Beneficial State Foundation, CapEQ, and Mission Driven Finance are approaching investments in an equitable way, taking in the individual’s story and character, and providing them with investment deals that weren’t happening before.