We sat down with our Chief Legal Officer Joe Pileri to learn about fund basics and what a fund is in the context of impact investing and Mission Driven Finance. After all, managing funds makes up a lot of what we do at Mission Driven Finance! Here we share an abbreviated version of our discussion to help demystify our work.

First, what even IS Mission Driven Finance?

We were built to connect the community with capital.

On the one hand, we know there are entrepreneurs and nonprofit leaders doing impactful work in their communities. They could probably do their work a bit better if only they had more money.

We can think of the gap between businesses and nonprofits and the capital they need as a giant gulf.

On the other end of this gulf are people who have access to money and are interested in the work that the entrepreneurs and nonprofit leaders want to do.

What they don’t have is a mechanism for providing those businesses and nonprofits the money (besides donations). That is Mission Driven Finance’s job—to bridge that gap.

To close gaps in the system, we needed to sit in the spaces between conventional capital and community pillars. Accordingly, Mission Driven Finance is structured not as a nonprofit, not as a CDFI, and not as a clear-cut conventional fund manager.

Instead, our parent company that employs our team is:

- A California Limited Liability Corporation (LLC) for flexibility

- A Certified B Corporation to ensure that impact is central and independently reviewed, and

- An Exempt Reporting Adviser within the SEC’s Registered Investment Adviser framework in order to work with investors and partners

Mission Driven Finance, LLC often serves as the general partner (GP), manager, or investment adviser for private fund vehicles.

We consider ourselves a hybrid organization—part asset manager, part consultant, part educator, and guide. We work across the capital continuum from philanthropy to institutional investors.

Because of the above, Mission Driven Finance has a unique vantage point in the market.

So…what is a fund?

A fund, in the simplest sense, is money designated for a particular purpose.

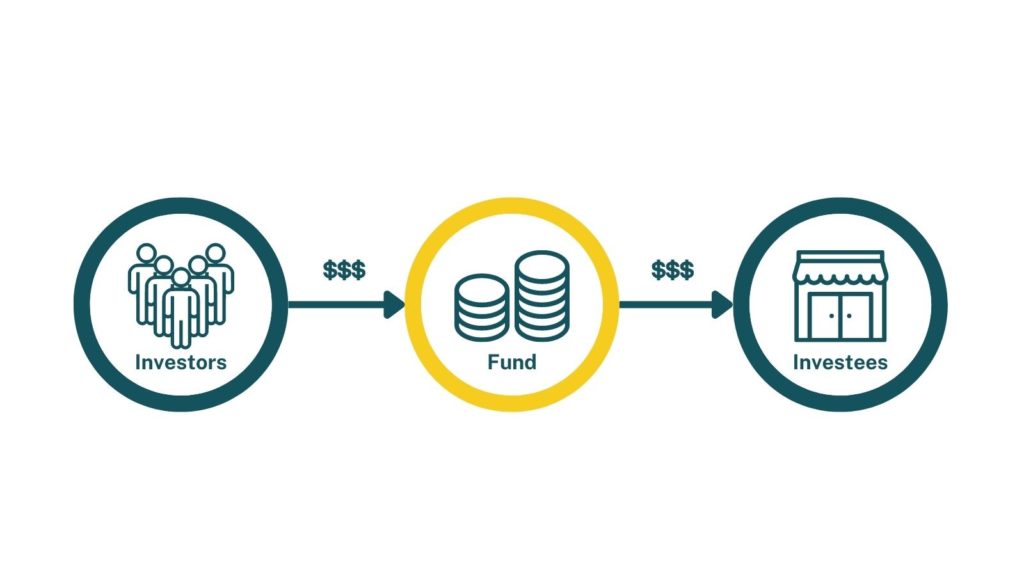

Think about a fund as its own company that has taxes, bank accounts, and a corporate structure. It exists as a standalone entity with the purpose of moving money into companies, organizations, or other funds. We use funds to create pools of money for entrepreneurs.

How does a fund get this pool of money?

A fund gets money from investors—people who contribute money to an enterprise, business, or fund, with some expectation of return. In the case of impact investing, investors seek both a financial and a social or environmental impact return on their capital.

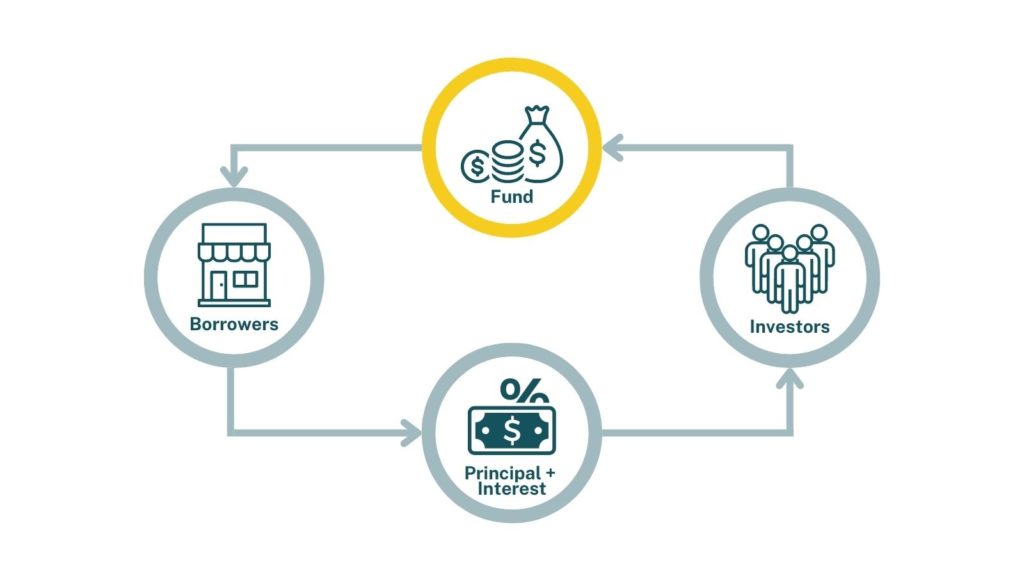

There are two key ways investors can provide money to a fund. We typically work with equity and debt.

Equity is the purchase of a stake in the ownership of a company or fund. The investor is entitled to a share of the profit (and loss) of the entity. Repayment from an equity investment is often tied to milestones and not a specific timetable.

Debt is a loan—money borrowed by a borrower and to be paid back to the lender on an agreed-upon schedule with interest for using it—kind of like paying rent on a vacation home for the time that you’ve rented it. In the case of a fund—when we’re talking about the investors—the borrower is a fund. The majority of our investors invest in this way.

David Lynn, the CEO & co-founder of Mission Driven Finance, explains, “A fund can make investments in the form of debt or equity. Any of the investments can be debt, equity, or a combination of both.”

Why most Mission Driven Finance investors are lenders

Mission Driven Finance primarily makes loans as that’s the gap we identified in the market. We also mostly have debt from our investors, not LP shares (equity).

One of the reasons is because it’s relatively simple: we accept money from investors at a certain percentage and for a certain amount of time and then we lend that out to small businesses and nonprofits for some percentage and amount of time within that investor window.

Another big reason is the variety of regulatory requirements that our investors have. Debt investments into funds have different risk considerations than equity investments and debt structures work for our current investors.

How does money move from a fund into community organizations?

Now that funds have raised money by taking money from investors, we need to move this money out to achieve its purpose. How does it do that? It makes investments into investees—portfolio companies like small businesses and nonprofits.

The investees that received capital from the fund in the form of a loan or equity investments are paying back that money.

In the case of debt, investees (borrowers) have payments of principal and interest that they make according to a set schedule called an amortization. That’s how a fund makes money. A fund then turns around and makes a kind of payment (maybe principal and interest, profit share) and pays the money back to the investors. The investors ideally end up with more money than they started with.

What is the role of an investment manager?

This is basically what Mission Driven Finance is.

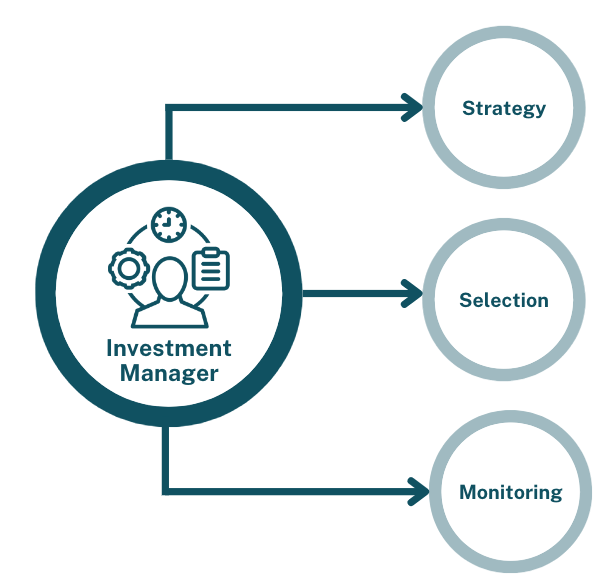

The investment manager is paid to manage this fund. Some of the responsibilities of the investment manager include:

- creating investment strategy

- selecting investments (underwriting/assessing risk & creditworthiness of potential borrowers, borrowers’ services, they are selecting for the fund)

- monitoring investments (make sure that things are going as we expect them to do)

So…is Mission Driven Finance a fund?

In our basic structure, Mission Driven Finance is not a fund. We are the investment manager. We are the mechanism that closes the gap between capital and community.

Lauren Grattan, co-founder and Chief Community Officer of Mission Driven Finance, says, “One-on-one investments are fairly simple, but start adding more investors or more enterprises on either side of the equation, and it gets more complicated. That’s what Mission Driven Finance specializes in. We are a team of savvy finance nerds not afraid of a challenge.”

Examples of partnerships include the Employee Ownership Catalyst Fund (in partnership with Project Equity) and WEPOWER St. Louis’ Elevate/Elevar Capital.

See some of our other client partners across the country here.

Connecting capital to community

A fund is a pool of money set aside by investors that can be used by borrowers (businesses, social enterprises, and nonprofits) to grow their organization, or continue or start a new project. Mission Driven Finance plays an important part as managers of the fund, making sure that investors’ capital is supporting mission-aligned borrowers and creating strategic partnerships with community developers, organizations, champions, and businesses to grow the fund and increase economic opportunity for the community.

Feel free to reach out to us at info@missiondrivenfinance.com with any questions.