Meet Laura Galinson, director of community relations at Mission Driven Finance and a dedicated philanthropist. Laura has worn an impressive number of hats, from a world-traveling and award-winning Associated Press photographer to a publicist at Harper Collins. Laura explains, “Even though I’ve had very different roles, my work has always been rooted in being a connector and changemaker.”

All posts by Editorial Team

Blended capital for immigration bonds: Introducing the Freedom100 Fund

Recently, our Co-founder and Chief Community Officer Lauren Grattan, and Freedom for Immigrants Co-founder and Co-executive Director Christina Mansfield spoke with Morgan Simon of Candide Group in Forbes.com to discuss why they launched the Freedom100 Fund—and how it’s a vital tool for investors and activists to join the fight for immigrant freedom.

Building a new, more equitable normal for small business and nonprofits

The COVID-19 pandemic has highlighted and exacerbated the effects of centuries of racist policies. If we don’t act fast, this crisis will rob our communities of vibrancy, diversity, and strength for many generations to come. The current global recognition of the deep roots of racism reinforces how critical it is to use all the tools in one’s toolbox to advance racial justice. As such, finance can and should be used as a tool for change in advancing economic and health equity in our communities. Together, we can turn the tide.

Fighting for immigrant rights during COVID-19

During times of crisis, it’s even more critical to uphold our values and stand up for those who are denied the right to stand up for themselves. Join our fight for immigrant rights by joining the Freedom100 Circle, a one-year commitment where members engage with Freedom for Immigrants and Mission Driven Finance to launch and grow our Freedom100 Bond Fund, while educating the public about the U.S. immigration detention system and community-based alternatives to detention.

Small businesses & nonprofits respond to COVID-19

The COVID-19 crisis has forced small businesses and nonprofits around the world, including our Advance borrowers, to forget business as usual and respond in creative ways to best serve their community and survive—quickly. From delivering essential household goods and locally sourced food to staying connected with families by livestreaming nature walks, these businesses and organizations demonstrate the flexibility, resilience, and heart that make small businesses critical for communities to thrive.

AdvanceHER: Unlocking opportunities for women and girls in San Diego and abroad

In our quest to increase economic opportunity for underestimated groups, we knew we’d want to emphasize supporting women and girls. With a diverse and largely female team, empowering more women has always felt natural to us. We’ve long wanted to connect the resources and needs of our community in new intentional ways that make a real impact on gender inequality.

Support Local Black-owned businesses in San Diego and watch our communities thrive

The best way to celebrate Black History Month this year? Shop at local Black-owned small businesses.

Our team reflects on 2019 and looks forward to 2020

With 2019 officially behind us, our team took a second to celebrate our favorite wins, which helps us to also look forward and set goals for 2020.

The fight for immigrant & New American rights

Impact investing can unlock urgently needed finance quickly by using a catalytic model. The Freedom100 Fund combines the power of impact investing with Freedom for Immigrants’ proven national bond model to give immigrants a fighting chance at freedom by paying their bond and reconnecting them with loved ones and legal services, at no cost to the family.

San Diego local & impactful shopping guide

The following handpicked businesses are sure to satisfy everyone on your list while supporting local business owners who care about our community.

Why I invest: Kara Ballester

As lead investors in our Homebuilding Investment Fund, Kara Ballester and her husband Andy were instrumental in jumpstarting our efforts to accelerate affordable housing with San Diego Habitat for Humanity. We wanted to know—what motivated Kara to invest in affordable homeownership, and what has her experience with impact investing been like?

Closing education gaps with creative capital

Our flexible, personalized financing approach allowed us to provide Friends of Willow Tree a $100,000 bridge loan that they used for expenses at the start of the school year, keeping the program affordable and accessible for their majority low-income students.

How can we make investing in our community a great investment? Flip the conventional finance model on its head.

The idea for Advance came from speaking with people who wanted to invest in their communities and the issues that they cared about but didn’t know how.

Developing community with creative capital

When we first met Kris Schlesser, founder of LuckyBolt, he was six years into a quest to make the perfect breakfast burrito easily accessible to professionals on the go, and had been financing the business with high-interest credit cards and microloans.

Storytelling for Change: Going beyond diversity to create belonging at work

We expected to learn strategies to better communicate with the public, but we walked away with so much more than that.

Women build the future of affordable homeownership

We had the honor of hanging out with inspiring women leading change during our Women Build the Future breakfast with San Diego Habitat for Humanity.

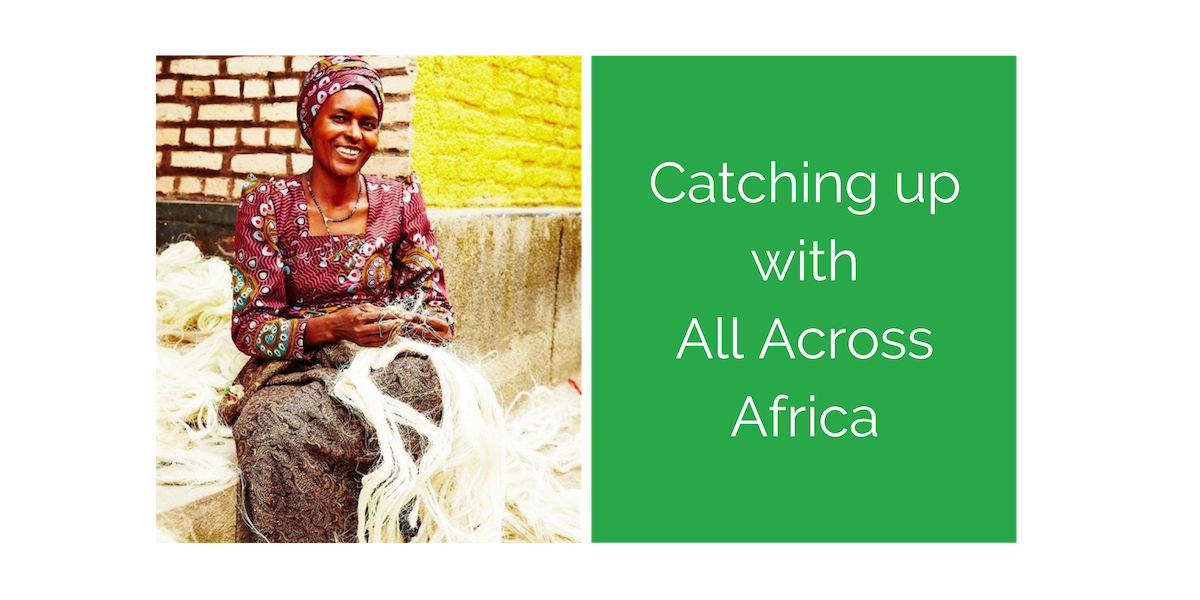

Supporting African artisans at work and beyond

“I have managed to invest…but one of the proudest things I have been able to do is pay for all of the school fees for my 7 children.”

—Seraphine, artisan

New financing model unlocks millions to build affordable homes

Charitable & private investors have contributed more than $1 million to a revolutionary fund supporting affordable housing for low-income families.