Many of our team will be on the fall conference circuit again. If you see us, be sure to say hi!

All posts by Wilda Wong

Collaboration to Catalyze Impact

Impact Charitable and Mission Driven Finance discussed how charitable capital can accelerate impact for community-rooted funds. See how this partnership can make capital more accessible.

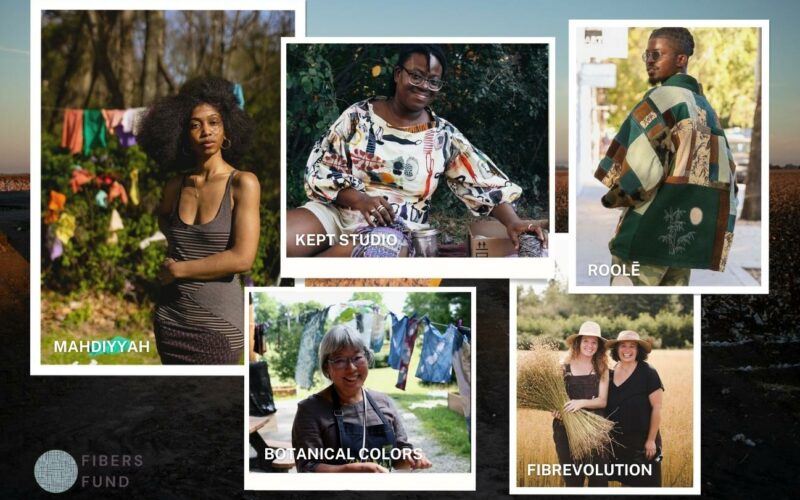

Fibers Fund announces first 5 grantees

Meet the first five grantees of the Fibers Fund: Botanical Colors, Fibrevolution, MAHDIYYAH, Kept Studio, and ROOLĒ.

Five properties in Clark County to become new ideal child care homes

Care Access Real Estate (CARE), a social impact specialty real estate investment trust (REIT) for child care operated by Mission Driven Finance, acquired five residential properties in Las Vegas, Clark County, Nevada.

WEPOWER Capital invests nearly $250k in St. Louis Black & Latinx-owned businesses

Since its launch, WEPOWER Capital has invested in 3 St. Louis Black and Latinx-owned companies: Bold Xchange, RooterMan by J3 Enterprises, and Cheryl’s Herbs.

Impact Charitable and Mission Driven Finance partner to connect more capital with community

Mission Driven Finance and Impact Charitable partner to accelerate the flow of impact-first capital by combining their unique expertise.

World Education Services announces lead commitment in Mission Driven Finance Capital Partners

With this investment to accelerate impact for communities across the country, World Education Services will help close capital gaps to close opportunity gaps.

SAFSF and Fibershed Announce the Launch of the Fibers Fund

SAFSF and Fibershed announced the launch of the Integrated Capital Fibers Fund with Mission Driven Finance, recognizing that natural fiber and dye crops can and should play a key role in vibrant, economically viable regenerative agriculture.

Sorenson Impact Summit 2023: The role of catalytic capital

Catalytic capital works to unlock investments that would not otherwise be possible — expanding opportunity, strengthening communities, and fueling innovation that benefits both people and the planet.

Everytable Secures $8M to Fund Trailblazing Social Equity Franchise Program

The Social Equity Franchise (SEF) Fund, managed by Mission Driven Finance, supports Everytable’s SEF program, which endeavors to close the opportunity gap for entrepreneurs seeking capital on their path to franchise ownership.

Asset Funders Network webinar: Innovative Financing for Child Care Facilities

Reimagining the infrastructure/ecosystem needed to support child care providers requires solutions that address historic and structural issues.

Mission Driven Finance selected as an ImpactAssets 50™ 2023 Manager

For the fourth year in a row, Mission Driven Finance is selected for the ImpactAssets IA 50 list, the impact investing industry’s first publicly available, searchable resource of fund managers zeroes in on some of the industry’s most impactful managers.

Meet the 2023 members of the Advance Advisory Committee

These regional community champions ensure the flow of Advance Strategy capital to underserved and overlooked communities.

39th Annual Economic Roundtable

At the 39th Annual Economic Roundtable, Laura Kohn made the case for child care as an affordable housing issue.

USC MSSE Jacobson Family Sustainable Impact Lecture Series: Engaging Communities as an ESG Pillar

Lauren Grattan participated in this conversation addressing the topic, “How Businesses are Centering Community in Social Impact.”

5 things to know about impact-based loans

If your business is too big for microfinance and SBA loan but too small for traditional banks, our impact-based loans can fill the gap.

Talking regenerative agriculture at the RFSI Forum

We all have a role to play to activate different forms of capital for positive outcomes in regenerative food and agricultural systems.

Investing in Community Infrastructure to Support Thriving Economies

In March 2022, Laura Kohn spoke at the National Interagency Community Reinvestment Conference attended by over 2,400 community development professionals.