The successful exit of the pre-development loan means construction has started! The first phase is scheduled to be completed in 2022.

All posts by Wilda Wong

SOCAP21 Panel on Catalytic Capital & Intersectional Equity

Through their portfolios, WES Mariam Assefa Fund, Impact America Fund, and Mission Driven Finance demonstrate how funders and investors can provide mission-driven organizations with flexible funding to innovate and scale up solutions that build more inclusive economies where everyone can contribute and thrive.

Growing like wildflowers

Earlier this year we shared some exciting and bittersweet team changes. Now that we are heading into the final quarter of the year, we want to share more about how our team is growing.

What’s a B Corp and why become one? Mission Driven Finance shares insights.

“Impact is a team sport and we all have a role to play, for-profit businesses included,” says Chief Community Officer Lauren Grattan. “B Corps embrace the idea that doing good is good business.”

Ownership Matters highlights Mission Driven Finance

This conversation took place between Elias Crim of Ownership Matters—a biweekly newsletter for the founders and funders of the emerging solidarity economy—and Mission Driven Finance’s co-founder and CEO, David Lynn, and Lauren Grattan, co-founder and Chief Community Officer.

What we learned while recruiting for the 2021 Community Finance Fellowship

This year, we opened the fellowship application to candidates nationwide. We received applications from 13 states, Washington, DC, and even one from another country!

Fifty by Fifty Employee Ownership News: Employee Ownership Catalyst Fund Preserves Local Businesses and Jobs

Project Equity and Mission Driven Finance announced on Labor Day the launch of the Employee Ownership Catalyst Fund, an evergreen debt fund that will offer flexible financing to businesses preparing for—or executing—an employee ownership transition. The fund targets businesses across the U.S. with 25 to 100-plus employees, particularly those employing frontline, low-wage workers and workers of color.

Project Equity launches new financing option to help local businesses build for the future

September 2, 2021 [Oakland, CA] —This Labor Day, small businesses have a new resource that could help them rebuild from the pandemic and secure their legacies while providing long-term careers for their employees. Project Equity, a national leader in the movement to...

Opinion: Here’s how we can help middle-income families in San Diego buy homes

How can investors and local business and nonprofit leaders address housing — and in particular attainable homeownership — through public-private partnerships? Our Chief Investment Officer Louie Nguyen looks at various approaches.

WEPOWER launches $1.5 million fund to invest in Black and Latinx entrepreneurs in North St. Louis

Mission Driven Finance is a founding partner of Elevate/Elevar Capital and will continue to support with fund administration.

San Diego Funders Invest $2 Million in Affordable Housing at City Heights Transit Plaza

With a new collaborative investment, the area near Normal Heights and City Heights is one step closer to having more affordable housing. A hundred and ninety affordable housing units are planned for the nearly 20,000-square-foot piece of land next to the City Heights Transit Plaza, at the corner of El Cajon Boulevard and 40th Street.

Announcing some exciting (and bittersweet) team changes

As Mission Driven Finance celebrates its fifth year flowing capital to community, we have seen our company grow and change many times, especially given our focus on being a deliberately developmental organization. This season feels like one of great change even with that mindset, and we want to make sure you learn about the latest team changes at Mission Driven Finance.

Community Finance Fellowship 2021 info session

If you missed the Community Finance Fellowship info session, check out the slides and recording here. Share with those you think are interested!

Congresswoman Sara Jacobs’ Request for $1 Million in Child Care Funding for San Diego County Included in FY 2022 House Appropriations Bill

The $1 million in federal funding for the Child Care Expansion Fund would be used by the County of San Diego to address the acute shortage of child care by helping small child care businesses expand. Mission Driven Finance, working with the County of San Diego and Congresswoman Jacobs, looks forward to filling the financial gaps and providing the support providers need to expand to care for more children and help more parents get back to work.

Social Impact Investing with David Cooper and Maggie Spicer

In this episode of the Essential Ingredients podcast powered by NextGenChef, host Justine Reichman talks with David Cooper—our senior portfolio advisor and co-founder of the 86 Fund—and fellow co-founder Maggie Spicer about impact investments and charitable capital investments through donor-advised funds (DAFs).

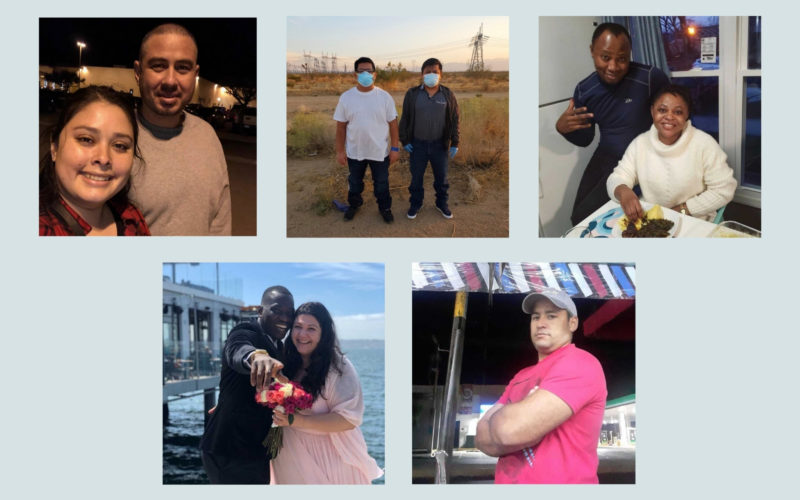

The Freedom100 Fund shows we can treat immigrants with dignity, not detention

Through a combination of impact-first finance, a coalition of dedicated philanthropic and impact investors, and an incredible organization advocating for immigrant dignity, 100 people are now free from immigrant prison.

Apis & Heritage Capital Partners Announces Initial Close of $30 Million to Turn Businesses with Workforces of Color into Employee-Owned Firms

Mission Driven Finance is delighted to support our client-partners at Apis & Heritage on their first fund to build wealth for workers of color through employee ownership.

Credit Sips: From Inclusive Theory to Inclusive Impact Investing

Sandhya Nakhasi of Community Credit Lab, Eric Horvath of Common Future, and Lauren Grattan of Mission Driven Finance discuss how they are using impact investing to build inclusive financial systems by centering communities.