Vibrant Indigenous Futures

New fund to mobilize public and private capital

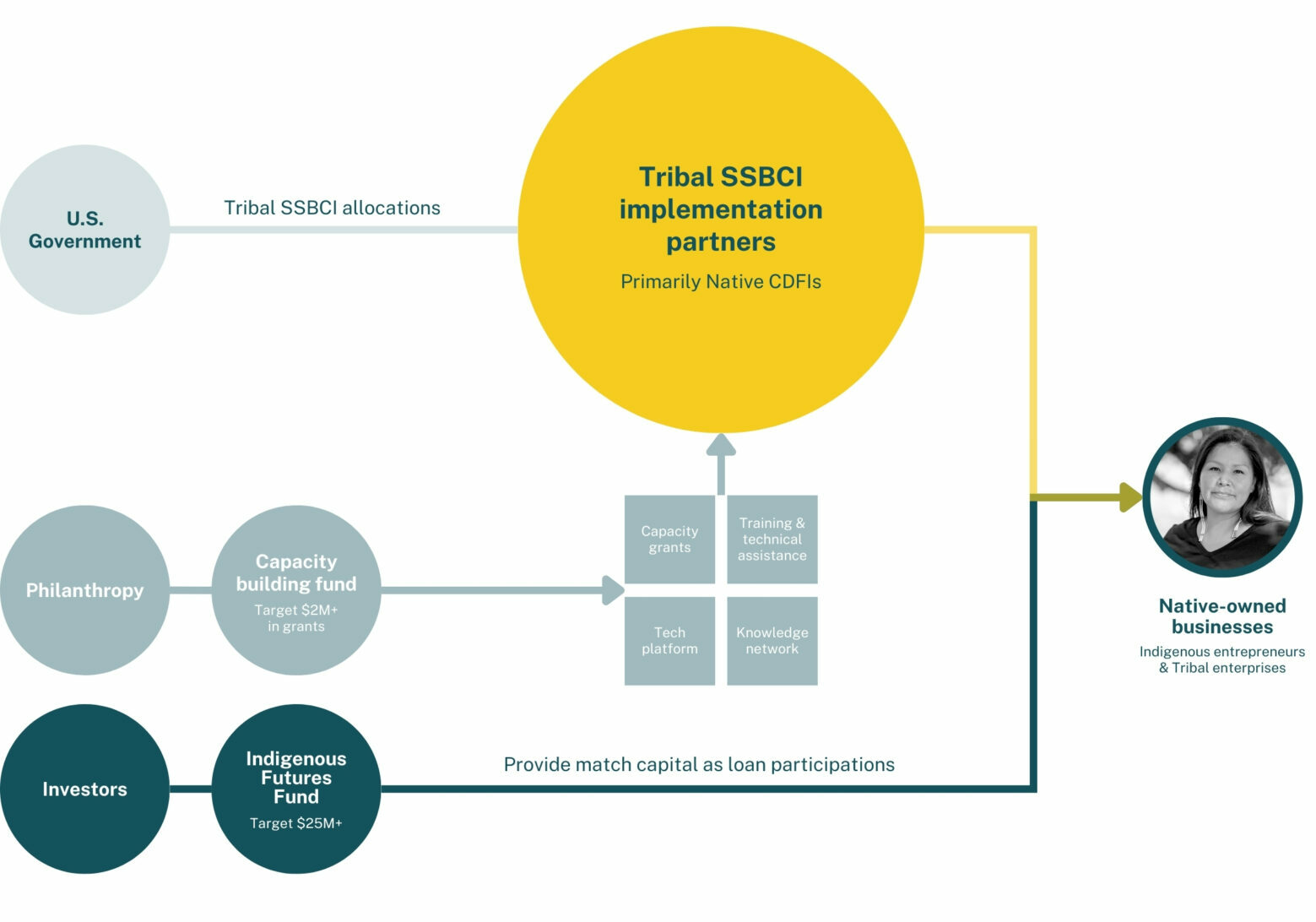

Flowing capital equitably in Indian Country

Announced at The White House in February 2024, the Indigenous Futures Fund is designed to speed up the flow of capital to Indigenous entrepreneurs and Tribal enterprises. The fund also intends to boost the capacity of Native Community Development Financial Institutions (CDFIs) and other Native financial intermediaries.

Combining a target $25 million+ in credit and $2 million in grants, the fund aims to mobilize private impact investment capital, in order to match and unlock federal funding (initially from the U.S. Department of the Treasury through the State Small Business Credit Initiative, or SSBCI).

This way, Native financial intermediaries who know their communities best can direct funding to valued projects. Leaning into our experience setting up community investment funds, Mission Driven Finance can support Tribal SSBCI programs with implementation and streamlining match capital challenges.

“After generations of disinvestment, we are at a watershed moment with significant federal resources and incentives to funnel capital to Indian Country. Like any watershed, we need to ensure adequate and appropriate channels for that capital to be directed and absorbed by those communities themselves.”

Lauren Grattan

co-founder & chief community officer

Incredible public investments in Native-owned businesses

Indigenous entrepreneurship is on the rise…

325,000

Indigenous-owned companies in North America

$38 billion

in receipts

+201%

growth in Native American / Alaskan Native women-owned businesses (1997–2017)

…at an unprecedented moment of opportunity

$500 million

allocation through the State Small Business Credit Initiative (SSBCI)

$720 million

allocation to Tribes and Native communities through the Inflation Reduction Act (IRA)

$13 billion

over 10 years through the Bipartisan Infrastructure Law (BIL)

+65%

in increased share of government contract opportunities through the revised Buy Indian Act

The goal of the SSBCI program is to spur investment in local communities as we recover from the COVID-19 pandemic. The program has an emphasis on populations disproportionately affected by economic challenges. As an incentive from the federal government to attract more resources, it has a strict matching requirement to access those funds.

The need for private match capital

We recognize many Tribes have applied their own assets to match SSBCI funds and that those resources are limited. Most Tribes need supportive investors to fully use the program and fund as many Native businesses as possible.

Without match capital:

Many Tribes will not be able to use their allocations

Many innovative CDFIs won’t access SSBCI programs

Native businesses lose out on investments designed for their growth

Real-life example

A Native Economic Development Corporation in Northern California

Approved for a $1.5 million SSBCI allocation, now scaling their program

Reservation lending program supports key sectors like construction, trucking, agriculture, and fishing

Needs $1 million+ in match capital to use its full allocation

Our solution

What is the Indigenous Futures Fund?

$25 million in credit + $2 million in capacity building grants

Participates in loans originated by a network of Tribal SSBCI partners into eligible businesses and projects in their communities

Focuses on advancing economic opportunity in Indian Country

Works with partners with deep trust in Tribal communities and history of investing

Has a current demand for $30 million+ of private match capital

Intentional community investment

Intended impacts

Ownership/leadership

Representation by members of Indigenous populations

Workforce

Intentional quality jobs and/or path to equity ownership opportunities

Community

Underlying investments intended to benefit Indian Country, related to food, climate, health, education, or housing

Community finance

Strengthening a growing Native finance sector and ensuring Indigenous community finance lasts for seven generations

Unlocking public-private capital

Federal funding + third-party dollars mobilized as a result of investments

The big picture

Where the Indigenous Futures Fund fits in

L–R: Kevin Walker, CEO of Northwest Area Foundation; Wizipan Garriott, Principal Deputy Assistant Secretary for Indian Affairs, U.S. Department of the Interior; Lauren Grattan, Mission Driven Finance; Secretary Deb Haaland, U.S. Department of the Interior; Rosa Cabrera, Chan Zuckerberg Initiative; Ted Piccolo, Mission Driven Finance

Boosting the capacity of Native financial intermediaries

A dynamic and growing network of Native CDFIs and other intermediaries are working to get capital to promising projects and businesses in their communities.

But implementing any new program comes with challenges—especially with limited staff time.

With a target $2 million in grants for capacity building, Mission Driven Finance is working to make it easier for Native originators to get public-private capital out the door:

- Making sense of the jargon and acronym soup

- Helping to streamline processes related to eligibility and reporting

- Connecting Tribal SSBCI implementation partners to share best practices and lessons learned

Glossary

Indian Tribe

“Any Indian tribe, band, nation, or other organized group or community, including any Alaska Native village or regional or village corporation as defined in or established pursuant to the Alaska Native Claims Settlement Act”

Tribal enterprise

“A commercial activity or business managed or controlled by an Indian Tribe”

State Small Business Credit Initiative (SSBCI)

Part of the U.S. Department of the Treasury, SSBCI was established in 2010—reauthorized and expanded in 2021 through the American Rescue Plan Act—to provide $10 billion over the next 10 years to support small businesses across states, U.S. territories, and Tribal governments as the country emerges from the pandemic.

Initiative for Inclusive Entrepreneurship (IIE)

Announced in October 2022 by Vice President Kamala Harris, the Initiative for Inclusive Entrepreneurship (IIE) is a national effort to expand access to capital for small businesses owned by people of color. IIE harnesses the power of public-private collaboration to ensure the equitable implementation of the U.S. Department of the Treasury’s $10 billion State Small Business Credit Initiative (SSBCI), 40% of which is designated for socially and economically disadvantaged individuals (SEDI businesses). IIE’s investment strategy is led by Mission Driven Finance, Hyphen, JumpStart, and CNote with support from the Skoll Foundation. Also supporting the implementation of IIE’s capacity-building pilot are Founders First Capital Partners, Next Street, and Nowak Metro Finance Lab.

Indigenous Futures Fund

The Indigenous Futures Fund is a credit fund managed by Mission Driven Finance to accelerate the flow of federal funding to Indigenous entrepreneurs, Tribal enterprises, and key projects. The fund seeks to raise at least $25 million in investment capital to address the immediate needs and opportunities of Native businesses.

Fund proceeds will be primarily used for loan participations originated by a network of Tribal SSBCI partners, supporting the sovereignty and authority of Tribal Nations to direct resources in their communities. Approved Tribal SSBCI programs have a queue of Native businesses and projects being underwritten now for financing, but need match capital like the Indigenous Futures Fund to invest tens of millions of dollars into their communities this year.

A target additional $2 million in grants will support the long-term capacity of financial intermediaries working in Indian Country, particularly Native CDFIs.

The Indigenous Futures Fund is available to accredited investors only under Regulation D 506(c)

Read more

See related press and stories

The New Matriarchs

NC Magazine

Weaving Capital

NC Magazine

Cairnspring Mills, CTUIR and Tribal Partners Reshape the Future of Flour

PerishableNews.com

Native CDFIs partner in $9M financing for flour mill on Umatilla Reservation

Tribal Business News

Help us flow capital equitably to Indigenous communities