As an impact investment advisory firm that manages and builds funds with the goal of amplifying social impact, it was essential for us to reflect those values internally too: “Don’t just talk about it, be about it!”

The goal of everything we do at Mission Driven Finance is to advance more inclusive economic opportunity. Shared ownership has emerged as a sub-theme—with several client-partner funds, our processes with Care Access Real Estate child care providers (informed by the Purpose Futures Fellowship), and portfolio transactions with Islamic finance principles. Knowing how powerful ownership can be as a tool for inclusive voice and wealth-building, we were eager to extend the benefits of employee ownership for our team while staying within our special regulated landscape.

Not your conventional finance

In conventional* finance, ownership often consolidates both governance and economic rights. But it doesn’t have to be that way! By unpacking different rights, we can also share them across roles instead of reinforcing cycles of who already has power, money, and access gets more power, money, and access.

Let’s delve into the governance piece.

Why a staff council?

In the first half of 2022, Mission Driven Finance collaborated with the Democracy at Work Institute (DAWI) to forge a path to create a staff council—creating a charter and hosting listening sessions with the team.

The intention of creating a staff council is to allow staff to participate in decision-making within the company and provide input on some of our practices. This participatory culture aligns well with and amplifies the values and aspirations at Mission Driven Finance.

The staff council specifically has decision-making power on requests from co-founders Lauren Grattan and David Lynn, who do not participate in the council. In some instances, members of the staff council are encouraged to submit additional proposals in response to those requests.

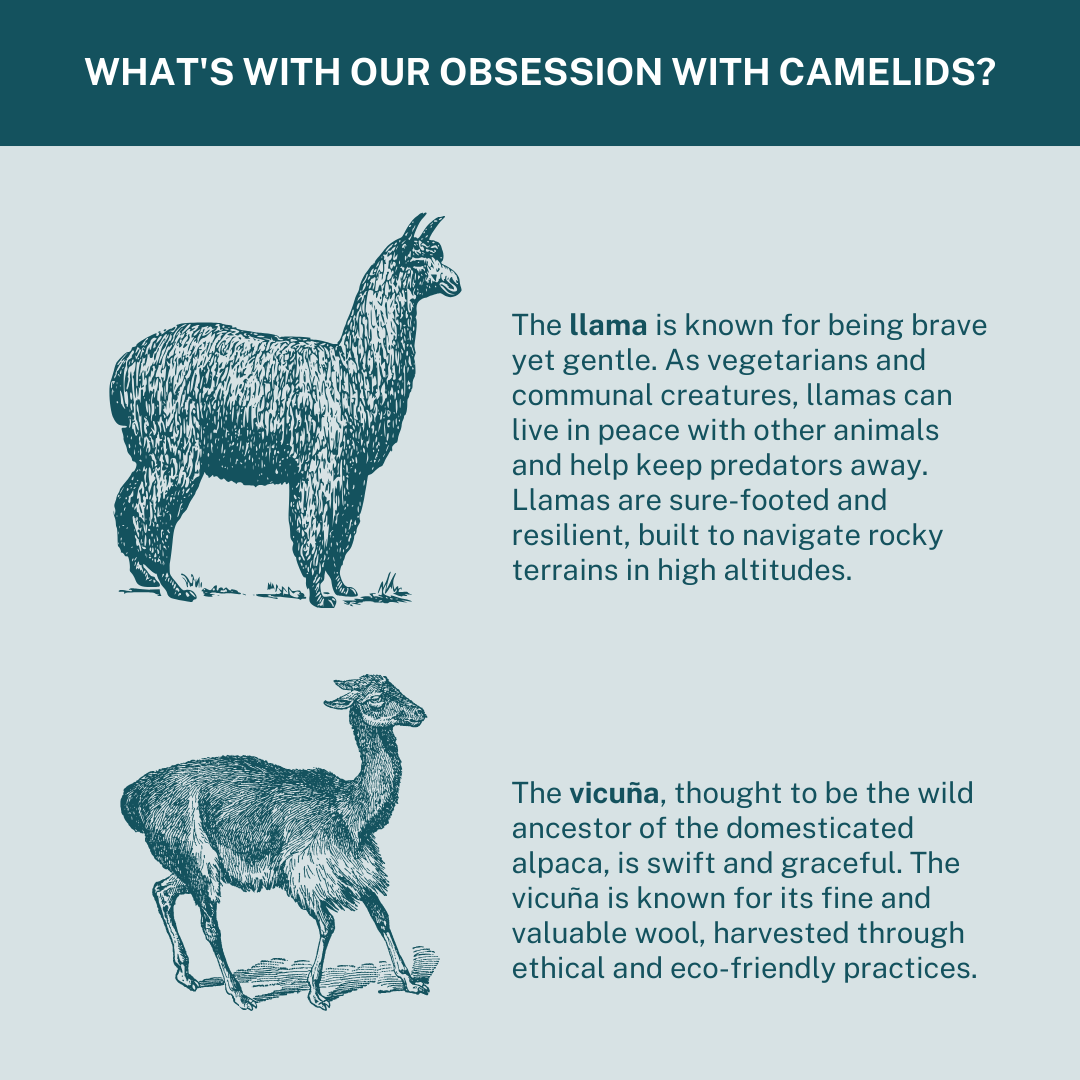

This council, comprising full-time team members who have been with Mission Driven Finance for at least two calendar quarters, is set to meet at least quarterly. At one of its first meetings, the staff council aptly named itself Camelid Congress, to reflect our affinity for the llama—our beloved unofficial company mascot—and alliteration.

To date, Camelid Congress has enhanced the initial charter, elected its officers, and shaped our short-term incentive program.

Camelid Congress also provided key input on a forthcoming employee fund, designed to be an opportunity for employees to benefit financially from the funds we manage and share in their success—eating our own cooking!

Kelsey Kays, a controller at Mission Driven Finance and the inaugural chair of Camelid Congress, shares, “This is a great example of how Mission Driven Finance diverges from the banking world where I come from. Cultivating a democratic voice is a big part of the company ethos, and I’m proud to serve my colleagues in this capacity.”

“In all my years in investment management, it is rare to see a staff council with decision-making power in this industry,” adds Thai Nguyen, the vice president of fund services at Mission Driven Finance and secretary of Camelid Congress, “It is even rarer to see an employee fund developed that can benefit us in the long term.”

In true camelid fashion, the council decided to name the employee fund the Vested Vicuña Vehicle.

Why an employee fund?

By investing 5% of payroll costs, seeded by Mission Driven Finance, the Vested Vicuña Vehicle allows the team to share in the success of the funds we manage—both our own strategies and funds with our client-partners—all while enriching our team’s understanding of our mission.

The employee fund is meant to add value to total compensation and long-term incentives. (Full-time employees have access to a 401(k) retirement plan—separate from the employee fund—that includes a 4% employer match and immediate vesting.)

Via the Camelid Congress and a subcommittee, staff has direct input in where employee fund capital is invested. For example, members of the Camelid Congress might vote to have the Vested Vicuña Vehicle invest more or less of available capital in place-based entrepreneurship or shared ownership.

The Vested Vicuña Vehicle also provides a hands-on professional development opportunity for team members not on investment teams to have exposure to a different process, creating greater awareness and appreciation of what happens on our programmatic and investment side, and building skills that can be applicable in their personal investing.

Ronnie Hughes, Jr., a controller at Mission Driven Finance, was one of three staff members elected to the employee fund subcommittee. “Every day I work on the accounting side of the funds we manage, but I am grateful my peers have entrusted me to work on a fund where we as a team have a higher personal stake.”

Another subcommittee member, Yaneli Segura, legal operations associate at Mission Driven Finance, says, “I joined the team because I wanted to contribute to using finance as a tool for change. Vested Vicuña Vehicle is such a cool and concrete way to bring home that concept.”

Crystal Sevilla, relationship manager at Mission Driven Finance and a member of the subcommittee, adds, “This is another instance of Mission Driven Finance putting our money where our mouth is and walking the talk. It goes to show we truly believe in our house products and that impact investing can benefit all parties involved: investors, portfolio companies, funders, community—and yes—employees too.”

What’s next

Along with the creation of a staff council formalizing team voice in certain company decisions, profit-sharing is another major aspect of shared ownership culture. In the works after the launch of the employee fund, the company plans to implement employee profit-sharing as a long-term benefit and has outlined the key parameters and vesting schedule.

Sign up for more updates on how we are using finance as a tool for change.

*An important note on word choice: We’ve taken to describing extractive Western capitalist finance as “conventional.” Think the non-organic stuff at Sprouts or Whole Foods. We are not calling it traditional finance, because there are traditions before imperialism and colonization that were not quite this extractive for everyone involved.