As a leader of a growing business or nonprofit organization, it’s so exciting when you get a commitment letter for a loan offer. But how do you know that these terms match the day-to-day needs of your organization?

If you’re working with us, our borrower services team will walk you through your payment schedule when the time comes, but it helps to know these concepts as you plan.

Here we break down in simple terms what a loan looks like in practice.

What are the words we are saying?

Say you get approved for a business loan of $100,000. Different terms—interest rate, term length, and amortization—can drastically affect your monthly cash flow.

Since interest rate is pretty common, let’s unpack the other terms and their effects.

- Term length refers to how much time you have to repay the loan

- Amortization comes from Latin and French meaning to kill off, which is gross, but it essentially defines how your payments chip away at the principal—the original amount borrowed—and interest, a fee charged for borrowing money.

An amortization table lays out your payment schedule and clarifies how much of each payment is for interest and how much is paying down the principal.

Let’s take a look at what we mean.

What does a $100,000 loan look like in real life?

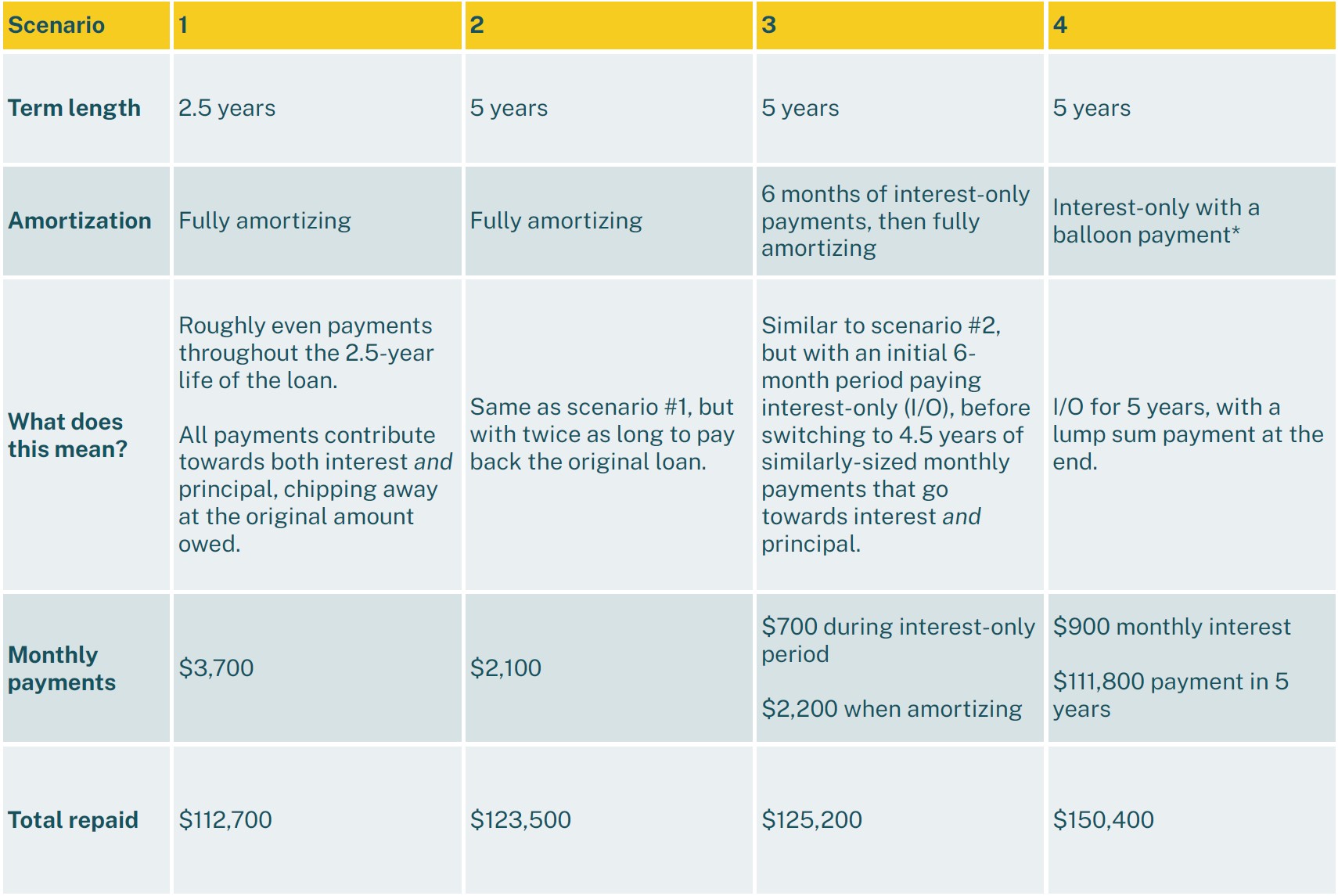

These four sample scenarios of a $100,000 loan, all at an annual interest rate of 8.5% show how very different your life can be with different business loan terms. Note that these are SAMPLE SIMPLIFIED figures (rounded to the nearest hundred dollars) for discussion purposes only.

*In order to balance the long-term needs of both our investors and our borrowers, Mission Driven Finance generally does not issue loans with long interest-only periods. To calculate other scenarios, visit calculator.net/loan-calculator.html.

Term length

We’ll start by comparing scenarios 1 and 2. You can see that the shorter your term length, the less time there is to accrue interest on your outstanding principal. For you as a borrower, that’s the cheapest total option.

However, you’re also splitting the $100,000 principal across fewer months, so the amount you pay each month is higher than with a longer-term loan. Bigger monthly payments allow you to repay faster!

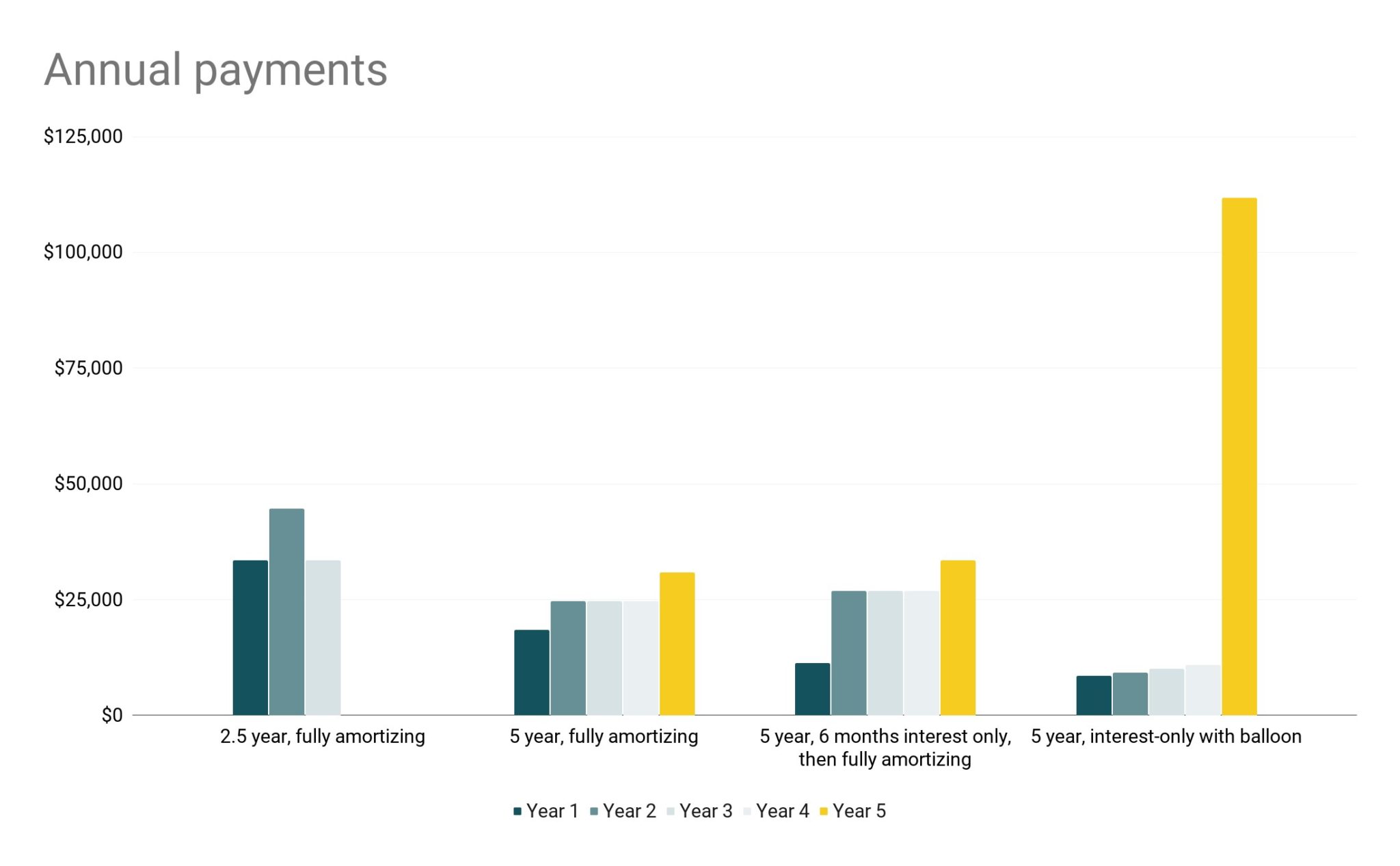

You can see that in the graph below, simplified to show five years at a time.

Different amortizations affect your business cash flow.

Amortization

Now let’s look at the differences in amortization across scenarios 2, 3, and 4.

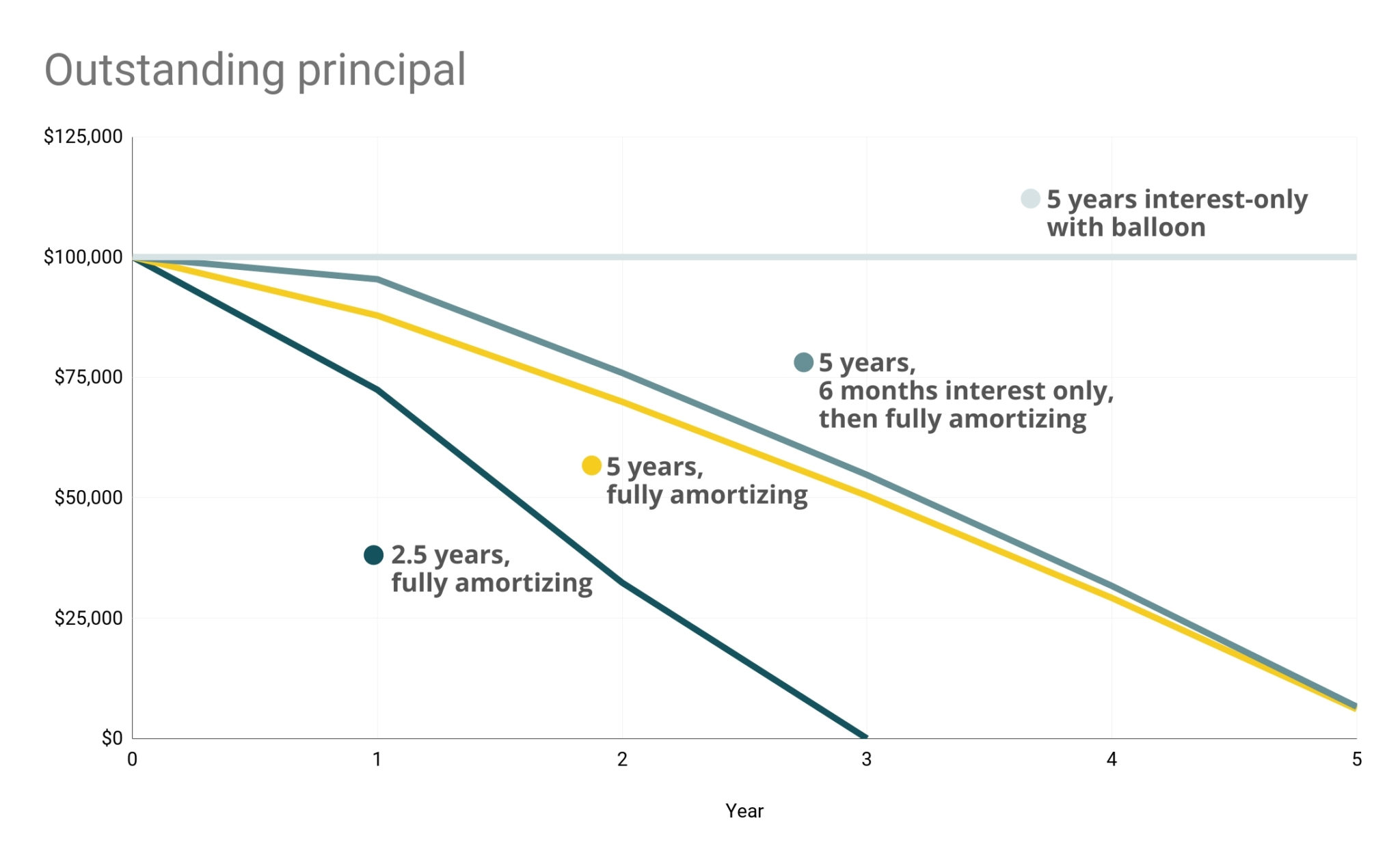

As noted above, fully amortizing loans have roughly even payments throughout the term length. All payments contribute towards both interest and principal, chipping away at the original amount owed. In this way, at the end of the loan term, you’ve fully paid off the debt.

Interest-only (I/O) payments are the opposite. You’re basically just paying a monthly rental fee and still owe the original amount (principal) afterwards.

Interest-only periods can be for part of the term length, as is the case in scenario 3. Or, as in scenario 4, the entire term length can be interest-only payments, with principal due at maturity. This special case is also called I/O with a balloon payment because of how the payments graph above looks like a relatively skinny string that ends in a big balloon.

In the chart below, you can see how the different loan scenarios “kill off” the original principal in different amortizations.

Amortizations affect how much of the original capital you still owe.

So why do businesses request interest-only loan payments?

Maybe you need a loan to invest in equipment to execute a contract. You might request interest-only payments for the time between the equipment purchase and getting paid for successfully completing the contract. This short I/O period can keep expenses relatively low until your business’ payday.

While lower monthly payments may be enticing, long interest-only periods can be tough to manage. Jumping from a routine of $900 monthly interest-only payments to suddenly having a lump-sum principal payment of $100,000 (scenario 4) is a challenge!

For that reason, and to balance the long-term needs of both our investors and our borrowers, Mission Driven Finance generally does not issue loans with long interest-only periods.

We hope this demystified some common business loan terms and amortization scenarios!