Ahead of SOCAP23, World Education Services brought together partners to forge trust, nurture relationships, share expertise, and gather insights on how we can collectively influence the field.

immigrants

Letters from Lauren: July 2022

No summer slowdown here, we are seeing tons of activity across our various funds.

Lauren Grattan is Named Immigration Advocate by Business for Good

Lauren Grattan was named Immigration Advocate at Business for Good San Diego’s 2021 Awards for her efforts to advance an inclusive economy.

SOCAP21 Panel on Catalytic Capital & Intersectional Equity

Through their portfolios, WES Mariam Assefa Fund, Impact America Fund, and Mission Driven Finance demonstrate how funders and investors can provide mission-driven organizations with flexible funding to innovate and scale up solutions that build more inclusive economies where everyone can contribute and thrive.

Ownership Matters highlights Mission Driven Finance

This conversation took place between Elias Crim of Ownership Matters—a biweekly newsletter for the founders and funders of the emerging solidarity economy—and Mission Driven Finance’s co-founder and CEO, David Lynn, and Lauren Grattan, co-founder and Chief Community Officer.

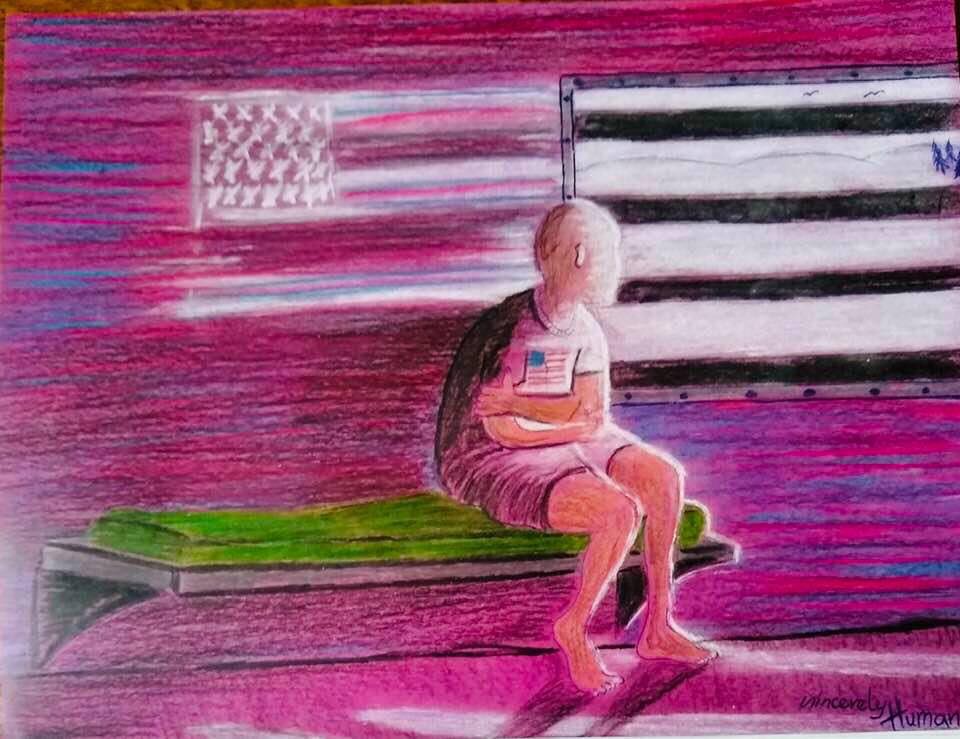

The Freedom100 Fund shows we can treat immigrants with dignity, not detention

Through a combination of impact-first finance, a coalition of dedicated philanthropic and impact investors, and an incredible organization advocating for immigrant dignity, 100 people are now free from immigrant prison.

What we learned in our very first Community Finance Fellowship

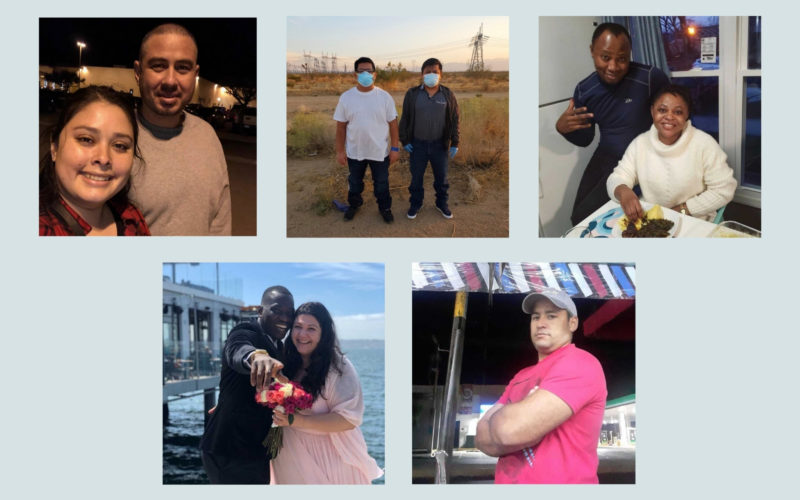

We are proud to announce that the first cohort of the Community Finance Fellowship—Louise Jordan, Benson Ochira, Andrew Moncada, Essence Rodriguez, and Crystal Sevilla—is graduating.

People on the Move info session

Missed the info session? See the recording and slides here.

First $1.5M deployed to San Diego County nonprofits hit by COVID-19

San Diego-based impact investment fund manager Mission Driven Finance has deployed $1.5M in loans to San Diego County nonprofits that have been impacted by COVID-19, thanks to $5M in seed funding from The San Diego Foundation as part of the San Diego County COVID-19 Small Business & Nonprofit Loan Program.

Blended capital for immigration bonds: Introducing the Freedom100 Fund

Recently, our Co-founder and Chief Community Officer Lauren Grattan, and Freedom for Immigrants Co-founder and Co-executive Director Christina Mansfield spoke with Morgan Simon of Candide Group in Forbes.com to discuss why they launched the Freedom100 Fund—and how it’s a vital tool for investors and activists to join the fight for immigrant freedom.

Community Finance Fellowship: Learning to use finance as a tool for change in a time of action

The inaugural cohort of Community Finance Fellows—Louise Jordan, Andrew Moncada, Benson Ochira, Essence Rodriguez, Crystal Sevilla— impress and inspire us every day and it’s not fair to keep their wisdom to ourselves. So we invited them to share their thoughts on how finance can invoke true racial and economic justice. The fellows’ perspectives and lived experiences give us invaluable insight into how we can use finance as a tool for real impact.

Fighting for immigrant rights during COVID-19

During times of crisis, it’s even more critical to uphold our values and stand up for those who are denied the right to stand up for themselves. Join our fight for immigrant rights by joining the Freedom100 Circle, a one-year commitment where members engage with Freedom for Immigrants and Mission Driven Finance to launch and grow our Freedom100 Bond Fund, while educating the public about the U.S. immigration detention system and community-based alternatives to detention.

WES Mariam Assefa Fund Spotlights Mission Driven Finance

WES Mariam Assefa Fund, one of the visionary supporters of the Community Finance Fellowship, spotlights Mission Driven Finance.

How the Community Finance Fellows are learning during a pandemic

While sheltering-in-place during a pandemic, we welcomed five Community Finance Fellows to our team in March to begin learning in a virtual environment: Louise Jordan, a renewed San Diegan with a legal background who moved back from Virginia to join us; Andrew Moncada, a financial analyst from Florida who wants to run his own impact investment firm one day; Benson Ochira, a refugee from Uganda with a degree in business management; Essence Rodriguez, an undergrad research fellow with the U.S. Immigration Policy Center; and Crystal Sevilla, an executive assistant from San Diego with a deep interest in economics and finance. See how they are learning during a pandemic.

Small businesses & nonprofits respond to COVID-19

The COVID-19 crisis has forced small businesses and nonprofits around the world, including our Advance borrowers, to forget business as usual and respond in creative ways to best serve their community and survive—quickly. From delivering essential household goods and locally sourced food to staying connected with families by livestreaming nature walks, these businesses and organizations demonstrate the flexibility, resilience, and heart that make small businesses critical for communities to thrive.

Our team reflects on 2019 and looks forward to 2020

With 2019 officially behind us, our team took a second to celebrate our favorite wins, which helps us to also look forward and set goals for 2020.

The fight for immigrant & New American rights

Impact investing can unlock urgently needed finance quickly by using a catalytic model. The Freedom100 Fund combines the power of impact investing with Freedom for Immigrants’ proven national bond model to give immigrants a fighting chance at freedom by paying their bond and reconnecting them with loved ones and legal services, at no cost to the family.

How can we make investing in our community a great investment? Flip the conventional finance model on its head.

The idea for Advance came from speaking with people who wanted to invest in their communities and the issues that they cared about but didn’t know how.