We sat down with our Chief Legal Officer Joe Pileri to learn about fund basics and what a fund is in the context of impact investing and Mission Driven Finance.

loans

Mission Driven Finance selected as an ImpactAssets 50™ 2022 Manager

The impact investing industry’s first publicly available, searchable resource of fund managers zeroes in on some of the industry’s most impactful managers.

Project Equity launches new financing option to help local businesses build for the future

September 2, 2021 [Oakland, CA] —This Labor Day, small businesses have a new resource that could help them rebuild from the pandemic and secure their legacies while providing long-term careers for their employees. Project Equity, a national leader in the movement to...

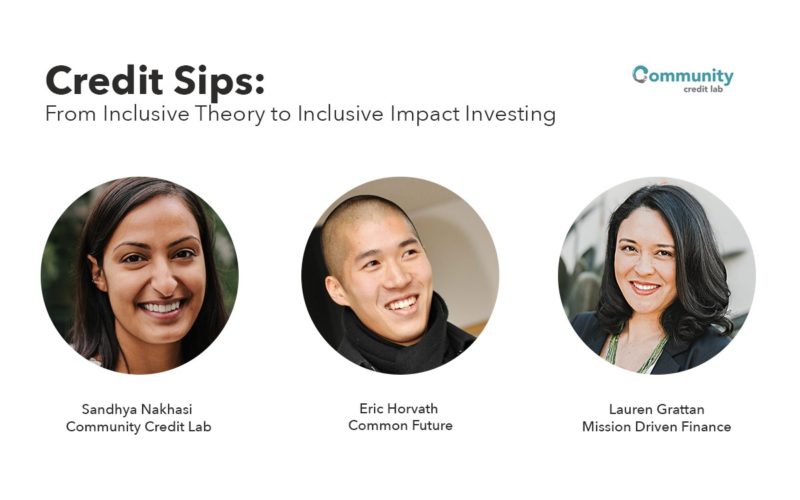

Credit Sips: From Inclusive Theory to Inclusive Impact Investing

Sandhya Nakhasi of Community Credit Lab, Eric Horvath of Common Future, and Lauren Grattan of Mission Driven Finance discuss how they are using impact investing to build inclusive financial systems by centering communities.

Two things to know about your business loan terms

It’s so exciting when you get a commitment letter for a loan offer. But how do you know that these terms match the day-to-day needs of your organization?

Financing alternatives for social impact companies

Our Senior Portfolio Advisor David Cooper joined co-founder and CEO of Sown to Grow, Rupa Gupta, to share their knowledge of financing alternatives for social impact companies from both the investor’s and entrepreneur’s perspectives.

Podcast de Negocios en Español: Como pedir un préstamo para tu negocio y cuando es el mejor momento

[En español] Andrew Moncada les comparte unas prácticas esenciales para conseguir una aprobación en su próxima solicitud de préstamo para su negocio.

What we learned in our very first Community Finance Fellowship

We are proud to announce that the first cohort of the Community Finance Fellowship—Louise Jordan, Benson Ochira, Andrew Moncada, Essence Rodriguez, and Crystal Sevilla—is graduating.

People on the Move info session

Missed the info session? See the recording and slides here.

Power of Community Financing info session

Are you a small business or nonprofit looking for working capital? Learn more here.

Mission Driven Finance selected as an ImpactAssets 50 2021 Emerging Impact Manager

Mission Driven Finance has been named as an Emerging Impact Manager in ImpactAssets’ IA 50 2021, the first publicly available database that provides a gateway into the world of impact investing for investors and their financial advisors, offering an easy way to identify experienced impact investment firms and explore the landscape of potential investment options.

Community Finance Fellowship showcase

Hear directly from the 2020 cohort fellows— Andrew Moncada, Essence Rodriguez, Louise Jordan, Crystal Sevilla, and Benson Ochira—about their career goals and their experiences thus far changing the face and flow of finance.

San Diego Foundation Sends First $1.5 Million To Nonprofits Hit By COVID-19 [KPBS]

The first $1.5 million in loans from The San Diego Foundation’s small business and nonprofit program have gone out to eight local organizations, the foundation announced Tuesday, part of a $5 million fund for organizations impacted by COVID-19.

First $1.5M deployed to San Diego County nonprofits hit by COVID-19

San Diego-based impact investment fund manager Mission Driven Finance has deployed $1.5M in loans to San Diego County nonprofits that have been impacted by COVID-19, thanks to $5M in seed funding from The San Diego Foundation as part of the San Diego County COVID-19 Small Business & Nonprofit Loan Program.

San Diego County expands small business loan program to include businesses in cities [The San Diego Union-Tribune]

“San Diego County supervisors unanimously agreed Tuesday to expand the county’s $5 million small business loan COVID relief program regionwide to small businesses operating in cities,” The San Diego Union-Tribune reports.

Building a new, more equitable normal for small business and nonprofits

The COVID-19 pandemic has highlighted and exacerbated the effects of centuries of racist policies. If we don’t act fast, this crisis will rob our communities of vibrancy, diversity, and strength for many generations to come. The current global recognition of the deep roots of racism reinforces how critical it is to use all the tools in one’s toolbox to advance racial justice. As such, finance can and should be used as a tool for change in advancing economic and health equity in our communities. Together, we can turn the tide.

WES Mariam Assefa Fund Spotlights Mission Driven Finance

WES Mariam Assefa Fund, one of the visionary supporters of the Community Finance Fellowship, spotlights Mission Driven Finance.

Introducing the San Diego County COVID-19 Small Business and Nonprofit Loan Program

The San Diego County COVID-19 Small Business & Nonprofit Loan Program (SBNLP) is designed to help the small businesses and nonprofits at the heart of our community get back on track.

![San Diego Foundation Sends First $1.5 Million To Nonprofits Hit By COVID-19 [KPBS]](https://www.missiondrivenfinance.com/wp-content/uploads/2021/04/cafe-KPBS-story-800x500.jpg)

![San Diego County expands small business loan program to include businesses in cities [The San Diego Union-Tribune]](https://www.missiondrivenfinance.com/wp-content/uploads/2021/04/SD-County-admin-building-800x500.jpg)