Mission Driven Finance partners with The San Diego Foundation to empower communities through new models of investing in social change.

philanthropy

Transformative 25 Funds Creative Financing

Fund managers from Fair Food Network, Homestake Venture Partners, Flexible Capital Fund, Kachuwa Impact Fund, and Mission Driven Finance engage in a lively discussion about creative financing and integrated capital strategies. Moderated by Esther Park, CEO of Cienega Capital.

Catalyst’s Impact Investing Series: Strategic investments in small businesses to sustain resilient communities

Hear from peer funders and investors on lessons learned in providing entrepreneurship funding and technical assistance for small businesses. Leave with practical strategies that you can explore and implement in your post-COVID resiliency funding.

Nano PharmaSolutions featured in San Diego Business Journal

The San Diego Business Journal’s Fred Grier recently highlighted Kay Olmstead and Nano PharmaSolutions, Inc., which Realize Impact invested in through the Mission Driven Finance fund based on donor/investor recommendations.

Philanthropy Now podcast: Multiplying grantmaking power with impact investing

Hear how impact investing differs from traditional grantmaking, and how this philanthropic tool leverages financial capital and human resources to get important community projects off the ground. Learn how Mission Driven Finance, Social Finance, and Silicon Valley Community Foundation use this model to support especially underserved communities and address inequities in affordable housing, education, and more.

Financing alternatives for social impact companies

Our Senior Portfolio Advisor David Cooper joined co-founder and CEO of Sown to Grow, Rupa Gupta, to share their knowledge of financing alternatives for social impact companies from both the investor’s and entrepreneur’s perspectives.

What we learned in our very first Community Finance Fellowship

We are proud to announce that the first cohort of the Community Finance Fellowship—Louise Jordan, Benson Ochira, Andrew Moncada, Essence Rodriguez, and Crystal Sevilla—is graduating.

Why invest with a racial or gender equity lens?

We need more individuals thinking and acting in ways that take into account the dynamics of intersectionality—a framework that civil rights activist and lawyer Kimberlé Crenshaw coined—to provide a lens through which you can see where power comes and collides, where it interlocks and intersects.

Inside the mind of a donor: Cause chat with philanthropist Laura Galinson

Our Director of Community Relations Laura Galinson and Sharyn Goodson explore the importance of building authentic relationships with donors and dive deeper into understanding what drives a donor to give.

Why I invest: Rachel Lozano Castro

One of the youngest people to support Mission Driven Finance portfolio companies, Rachel Lozano Castro leaned into her passion and know-how to organize a shared donor-advised fund (DAF) with her family that supports our flagship place-based strategy Advance.

First $1.5M deployed to San Diego County nonprofits hit by COVID-19

San Diego-based impact investment fund manager Mission Driven Finance has deployed $1.5M in loans to San Diego County nonprofits that have been impacted by COVID-19, thanks to $5M in seed funding from The San Diego Foundation as part of the San Diego County COVID-19 Small Business & Nonprofit Loan Program.

Why I invest: Laura Galinson

Meet Laura Galinson, director of community relations at Mission Driven Finance and a dedicated philanthropist. Laura has worn an impressive number of hats, from a world-traveling and award-winning Associated Press photographer to a publicist at Harper Collins. Laura explains, “Even though I’ve had very different roles, my work has always been rooted in being a connector and changemaker.”

I am a White man. I must do more to fight systemic racism.

The best anti-racism advice I’ve gotten so far is from my teammate Louise Jordan: Whatever we do, we have to stop recreating the same narrative. Unfortunately, many of the actions we White people take end up reinforcing existing power dynamics and telling the same, false story—that Black people and people of color have inherent risk and problems and that White people must “save” them from themselves.

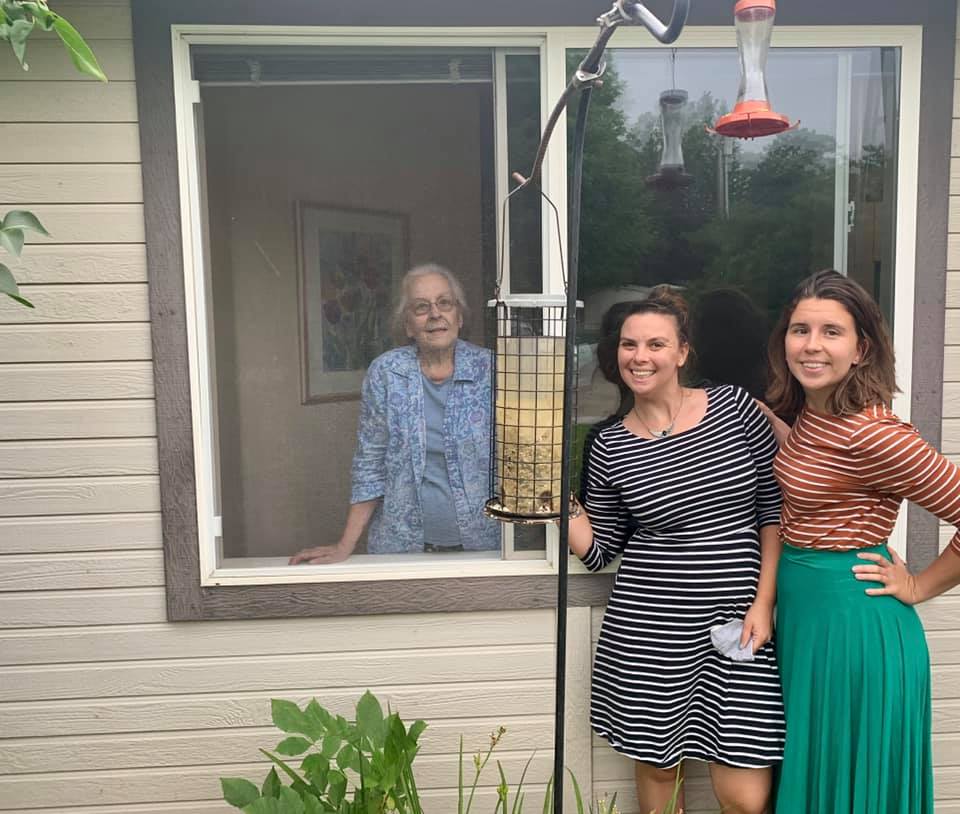

How the Community Finance Fellows are learning during a pandemic

While sheltering-in-place during a pandemic, we welcomed five Community Finance Fellows to our team in March to begin learning in a virtual environment: Louise Jordan, a renewed San Diegan with a legal background who moved back from Virginia to join us; Andrew Moncada, a financial analyst from Florida who wants to run his own impact investment firm one day; Benson Ochira, a refugee from Uganda with a degree in business management; Essence Rodriguez, an undergrad research fellow with the U.S. Immigration Policy Center; and Crystal Sevilla, an executive assistant from San Diego with a deep interest in economics and finance. See how they are learning during a pandemic.

Mission Driven Finance selected as an ImpactAssets 50 2020 Emerging Impact Manager

Mission Driven Finance has been named as an Emerging Impact Manager in ImpactAssets’ IA50 2020, a publicly available, online database for impact investors, family offices, financial advisors and institutional investors that features a diversified listing of private capital fund managers that deliver social and environmental impact as well as financial returns.

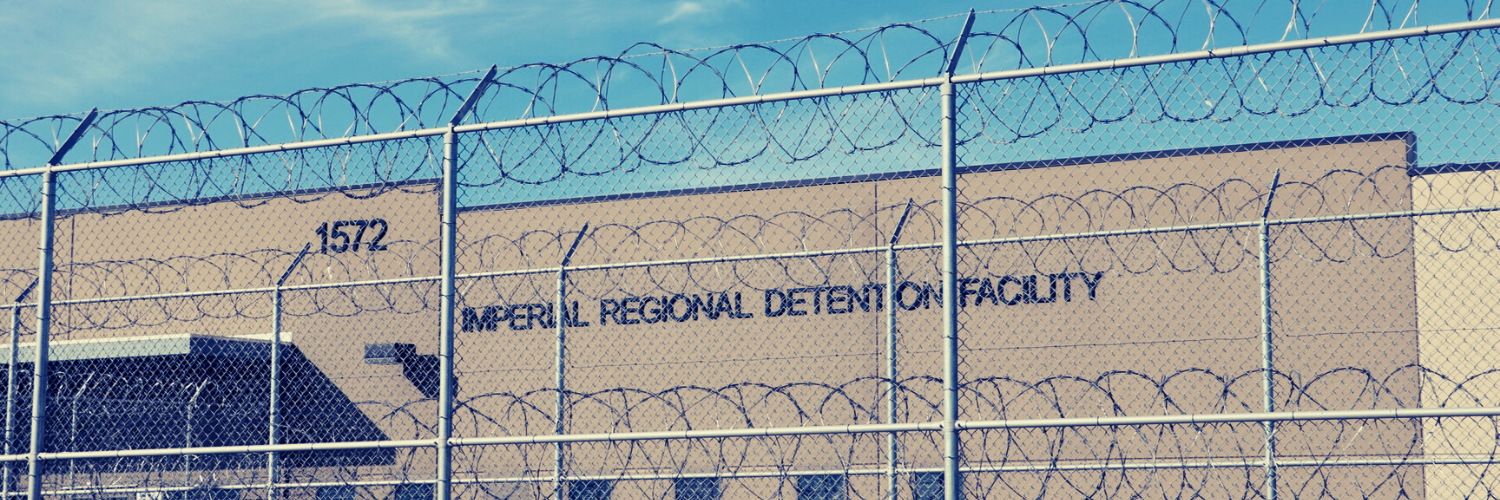

The fight for immigrant & New American rights

Impact investing can unlock urgently needed finance quickly by using a catalytic model. The Freedom100 Fund combines the power of impact investing with Freedom for Immigrants’ proven national bond model to give immigrants a fighting chance at freedom by paying their bond and reconnecting them with loved ones and legal services, at no cost to the family.

Insights From Innovators—interview with Cutting Edge Capital

Cutting Edge Capital spoke with Mission Driven Finance Co-founders Lauren Grattan and David Lynn to talk about our mission, and how our community-first perspective guides us to find investment opportunities.

How can we make investing in our community a great investment? Flip the conventional finance model on its head.

The idea for Advance came from speaking with people who wanted to invest in their communities and the issues that they cared about but didn’t know how.