Project Equity and Mission Driven Finance announced on Labor Day the launch of the Employee Ownership Catalyst Fund, an evergreen debt fund that will offer flexible financing to businesses preparing for—or executing—an employee ownership transition. The fund targets businesses across the U.S. with 25 to 100-plus employees, particularly those employing frontline, low-wage workers and workers of color.

portfolio

Project Equity launches new financing option to help local businesses build for the future

September 2, 2021 [Oakland, CA] —This Labor Day, small businesses have a new resource that could help them rebuild from the pandemic and secure their legacies while providing long-term careers for their employees. Project Equity, a national leader in the movement to...

Opinion: Here’s how we can help middle-income families in San Diego buy homes

How can investors and local business and nonprofit leaders address housing — and in particular attainable homeownership — through public-private partnerships? Our Chief Investment Officer Louie Nguyen looks at various approaches.

San Diego Funders Invest $2 Million in Affordable Housing at City Heights Transit Plaza

With a new collaborative investment, the area near Normal Heights and City Heights is one step closer to having more affordable housing. A hundred and ninety affordable housing units are planned for the nearly 20,000-square-foot piece of land next to the City Heights Transit Plaza, at the corner of El Cajon Boulevard and 40th Street.

The Freedom100 Fund shows we can treat immigrants with dignity, not detention

Through a combination of impact-first finance, a coalition of dedicated philanthropic and impact investors, and an incredible organization advocating for immigrant dignity, 100 people are now free from immigrant prison.

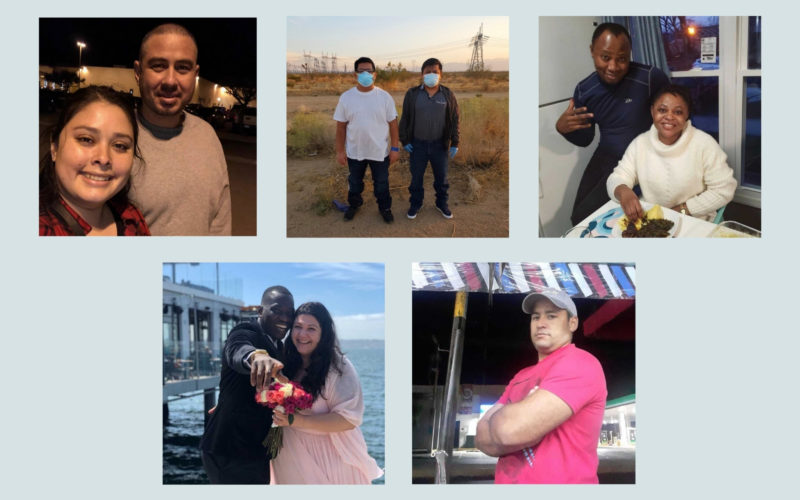

What we learned in our very first Community Finance Fellowship

We are proud to announce that the first cohort of the Community Finance Fellowship—Louise Jordan, Benson Ochira, Andrew Moncada, Essence Rodriguez, and Crystal Sevilla—is graduating.

First $1.5M deployed to San Diego County nonprofits hit by COVID-19

San Diego-based impact investment fund manager Mission Driven Finance has deployed $1.5M in loans to San Diego County nonprofits that have been impacted by COVID-19, thanks to $5M in seed funding from The San Diego Foundation as part of the San Diego County COVID-19 Small Business & Nonprofit Loan Program.

Real estate for early care & education: A promising venture

We’re honored to share that David—along with early care and education expert Laura Kohn and community finance fellow Essence Rodriguez—has joined the 2020 cohort of the Promising Ventures Fellowship to explore using real estate and finance to improve access to quality early child care.

Blended capital for immigration bonds: Introducing the Freedom100 Fund

Recently, our Co-founder and Chief Community Officer Lauren Grattan, and Freedom for Immigrants Co-founder and Co-executive Director Christina Mansfield spoke with Morgan Simon of Candide Group in Forbes.com to discuss why they launched the Freedom100 Fund—and how it’s a vital tool for investors and activists to join the fight for immigrant freedom.

Small businesses & nonprofits respond to COVID-19

The COVID-19 crisis has forced small businesses and nonprofits around the world, including our Advance borrowers, to forget business as usual and respond in creative ways to best serve their community and survive—quickly. From delivering essential household goods and locally sourced food to staying connected with families by livestreaming nature walks, these businesses and organizations demonstrate the flexibility, resilience, and heart that make small businesses critical for communities to thrive.

Finding the way back through evidence-based holistic treatment

The Way Back uses trauma-informed care in its client activities—clinical groups, education groups, mindfulness meditation, relapse prevention groups, codependency groups, anger management, emotional regulation, and individual psychotherapy. “We are training men to be better fathers, better husbands, better employees, to stay out of prison, to work, to communicate,” says The Way Back Executive Director Chris Thomas, a licensed therapist who has been sober for 25 years. “Men are an important part of family structure, and addiction is a family disease.”

COVID-19 letter to borrowers

We’re sharing with you—our community—the same message for small businesses and nonprofits that we provided to our active borrowers. During this challenging time, stay true to your values and support each other. None of us will come out of this unchanged. See our COVID-19 resources for small businesses and nonprofits.

AdvanceHER: Unlocking opportunities for women and girls in San Diego and abroad

In our quest to increase economic opportunity for underestimated groups, we knew we’d want to emphasize supporting women and girls. With a diverse and largely female team, empowering more women has always felt natural to us. We’ve long wanted to connect the resources and needs of our community in new intentional ways that make a real impact on gender inequality.

Our team reflects on 2019 and looks forward to 2020

With 2019 officially behind us, our team took a second to celebrate our favorite wins, which helps us to also look forward and set goals for 2020.

B Corp: Best for the World honoree

A year ago, we were certified as a B Corporation. This month we were named as one of the Best For The World for our incredible customers—the changemaking companies we support. We rank in the top 10% of all 3,000+ B Corps around the world for the positive impact we make together with our customers!

Closing education gaps with creative capital

Our flexible, personalized financing approach allowed us to provide Friends of Willow Tree a $100,000 bridge loan that they used for expenses at the start of the school year, keeping the program affordable and accessible for their majority low-income students.

How can we make investing in our community a great investment? Flip the conventional finance model on its head.

The idea for Advance came from speaking with people who wanted to invest in their communities and the issues that they cared about but didn’t know how.

Developing community with creative capital

When we first met Kris Schlesser, founder of LuckyBolt, he was six years into a quest to make the perfect breakfast burrito easily accessible to professionals on the go, and had been financing the business with high-interest credit cards and microloans.