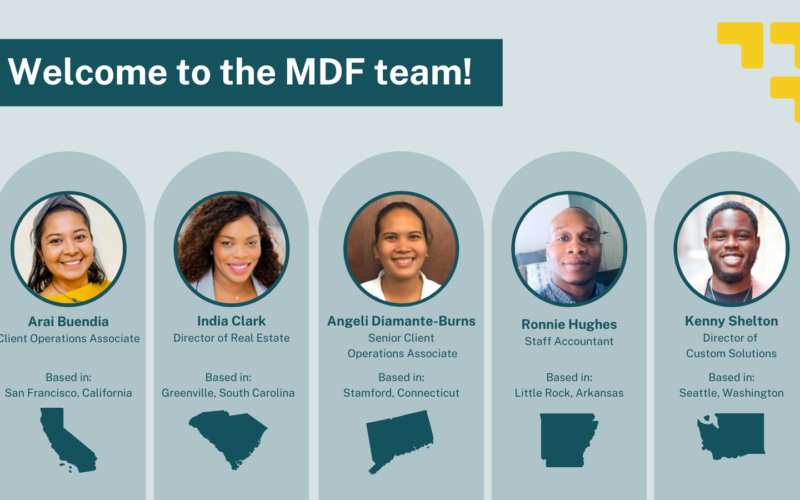

Mission Driven Finance is growing and we are welcoming 5 new hires and 4 internal promotions. Celebrate the growth with us!

racial equity

Over $5 million disbursed to San Diego nonprofits in 0% interest loans

It’s official—the San Diego County COVID-19 Small Business and Nonprofit Loan Program (SBNLP) has successfully disbursed $5.2M to nonprofits in San Diego County impacted by COVID-19.

Equitable homeownership: Reducing the wealth gap through shared ownership models

Laura Kohn joins this Purpose webinar to discuss the power of shared ownership in building community wealth.

Meet the members of new committee supporting integrity of flagship fund

Meet the ten regional community champions ensuring the flow of Advance Strategy capital to underserved and overlooked communities.

New advisory committee ensures money flows to San Diego small businesses & nonprofits

The Advance Advisory Committee collaborates with Mission Driven Finance to flow capital more equitably to small businesses and nonprofits.

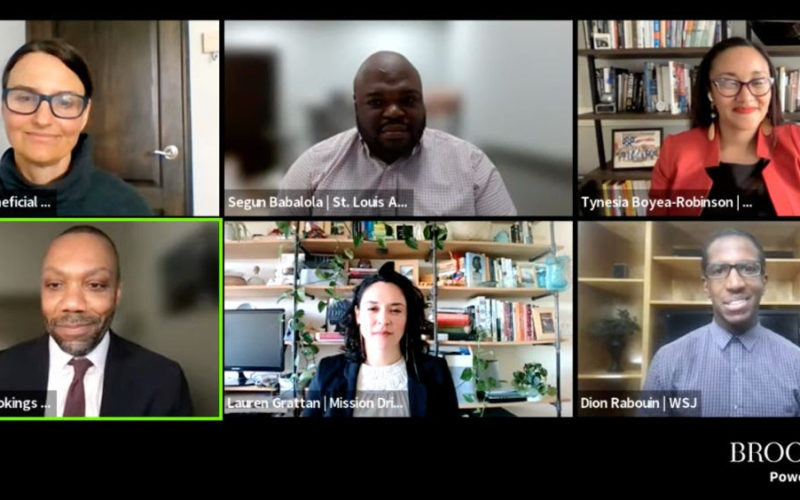

Mission Driven Finance participates in Brookings panel on the state of Black businesses

Learn about the current environment for Black-owned businesses and how to reimagine systems in order to create opportunities for capital and community connections.

[Video] Child Care Next Door: Investing in Homes as Child Care Infrastructure

Three family child care providers share their stories in a video produced by Mission Driven Finance in partnership with the National Children’s Facilities Network.

MDF’s Laura Olivas invited to join B Corporation BIPOC Leadership Team 2022

“Laura’s mission is to design and scale solutions that drive economic development and dismantle racist and inequitable systems. She is committed to ensuring that communities of color are not only beneficiaries but also driving solutions.”

What’s a B Corp and why become one? Mission Driven Finance shares insights.

“Impact is a team sport and we all have a role to play, for-profit businesses included,” says Chief Community Officer Lauren Grattan. “B Corps embrace the idea that doing good is good business.”

Ownership Matters highlights Mission Driven Finance

This conversation took place between Elias Crim of Ownership Matters—a biweekly newsletter for the founders and funders of the emerging solidarity economy—and Mission Driven Finance’s co-founder and CEO, David Lynn, and Lauren Grattan, co-founder and Chief Community Officer.

Fifty by Fifty Employee Ownership News: Employee Ownership Catalyst Fund Preserves Local Businesses and Jobs

Project Equity and Mission Driven Finance announced on Labor Day the launch of the Employee Ownership Catalyst Fund, an evergreen debt fund that will offer flexible financing to businesses preparing for—or executing—an employee ownership transition. The fund targets businesses across the U.S. with 25 to 100-plus employees, particularly those employing frontline, low-wage workers and workers of color.

Opinion: Here’s how we can help middle-income families in San Diego buy homes

How can investors and local business and nonprofit leaders address housing — and in particular attainable homeownership — through public-private partnerships? Our Chief Investment Officer Louie Nguyen looks at various approaches.

WEPOWER launches $1.5 million fund to invest in Black and Latinx entrepreneurs in North St. Louis

Mission Driven Finance is a founding partner of Elevate/Elevar Capital and will continue to support with fund administration.

Apis & Heritage Capital Partners Announces Initial Close of $30 Million to Turn Businesses with Workforces of Color into Employee-Owned Firms

Mission Driven Finance is delighted to support our client-partners at Apis & Heritage on their first fund to build wealth for workers of color through employee ownership.

What we learned in our very first Community Finance Fellowship

We are proud to announce that the first cohort of the Community Finance Fellowship—Louise Jordan, Benson Ochira, Andrew Moncada, Essence Rodriguez, and Crystal Sevilla—is graduating.

Why invest with a racial or gender equity lens?

We need more individuals thinking and acting in ways that take into account the dynamics of intersectionality—a framework that civil rights activist and lawyer Kimberlé Crenshaw coined—to provide a lens through which you can see where power comes and collides, where it interlocks and intersects.

Local impact investment firm Mission Driven Finance marks 5th anniversary with $11 million milestone

Marking two major milestones, we are celebrating our fifth anniversary this month as well as having disbursed $11 million in assets to the small businesses and nonprofits dedicated to social change in the region.

Living Cities announces capital investment in Mission Driven Finance to increase access to growth capital and support for social impact small businesses and nonprofits

Living Cities’ Blended Catalyst Fund (BCF) announces a $2 million commitment to Advance, a regional, inclusive place-based fund managed by impact investment firm Mission Driven Finance.

![[Video] Child Care Next Door: Investing in Homes as Child Care Infrastructure](https://www.missiondrivenfinance.com/wp-content/uploads/2023/05/CARE-video-providers-800x500.jpg)